In the Markets Now: Bitcoin Thoughts

With the 2024 presidential election now in the rearview mirror, one of the hottest topics in investing is (yet again) bitcoin and cryptocurrency. Here, we provide some thoughts on the interesting asset class.

Thinking About How to Think About Bitcoin

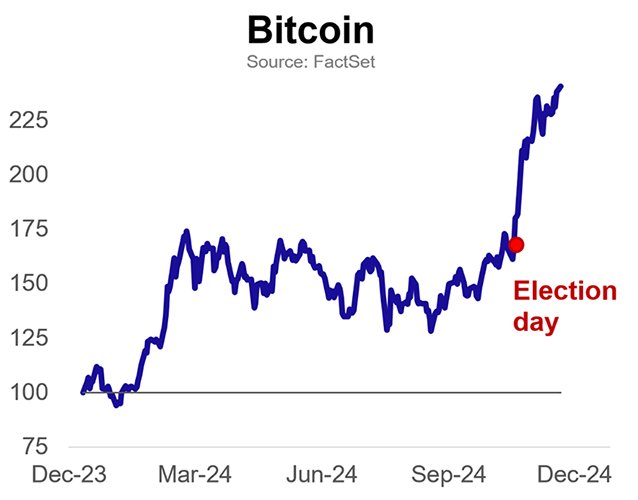

Bitcoin soaring. Since the presidential election on Nov. 5, the price of bitcoin has risen roughly 45%, and over the last three months, the price has nearly doubled from ~$53,000 to over $100,000. The “why” of the recent move – and a broader discussion of bitcoin – will be the subject of this piece in greater detail. But in short, President-elect Trump’s victory, as the clearly more crypto-friendly candidate (from promising a national bitcoin reserve to the pledging widespread deregulation efforts), has sparked a bullish surge in the asset. Because bitcoin does not have any inherent cash flows (earnings, dividends, interest, etc.) and is little used as a currency, it trades largely on sentiment, liquidity, and “adoption” potential. Bitcoin has a finite supply, so when demand is higher – due to interest from election coverage and/or broader institutional adoption – the price almost necessarily rises. Its supporters are also uniquely fervent, making sentiment/price swings far greater than a normal asset (along with the subsequent pile-on activity that supercharges most of its moves).

At this point, I will note that bitcoin and other cryptocurrencies are typically held in virtual wallets that cannot be custodied at Baird (nor a vast majority of peer firms) and crypto holdings are also largely exempt from industry-standard insurance coverage. For these reasons, bitcoin cannot be recommended (either for or against), and the recently-approved spot currency ETFs can primarily be purchased only on an unsolicited basis in brokerage accounts.

What is bitcoin? Our own Mike Antonelli did a longer video series on bitcoin that is worth checking out, but broadly, cryptocurrencies are digital currencies that use cryptography to secure transactions, with ownership records stored in a public digital ledger – i.e., the blockchain. The use of cryptography means that cryptocurrencies are not reliant on any central authority, such as a financial intermediary or central bank, to conduct transactions. Bitcoin is the first and most popular cryptocurrency, representing over 50% of total coin market cap. But it is far from alone – as of writing, there are nearly 2.5 million individual coins across 750+ exchanges. For the sake of this paper, we will focus on bitcoin given its size dominance and its first-mover advantage into the institutional wealth management landscape as an asset class.

Bitcoin was initially envisaged as a currency – a peer-to-peer version of electronic cash – but it’s not clear that it is yet being used as such all that often. The Federal Reserve found that in 2023, just 1% of surveyed individuals used crypto to buy something, make a payment, or transfer funds to friends/family, a decrease from 2022. It’s possible that this understates the overall usage – crypto is more popular in areas with less stable inflation and political regimes and it’s also likely that individuals using the anonymity granted by cryptocurrency to engage in illicit activity wouldn’t confess as much to the Fed. But regardless, Bitcoin’s volatility makes it an unreliable medium of exchange and its lack of acceptance by vendors makes it a flawed means of payment – not good things for “money.” And yet, it is up nearly 1,300% in the last 5 years – so what is driving the move?

Is bitcoin a store of value? The growing – and perhaps commonly accepted – investment narrative for bitcoin in 2024 is less about being a digital dollar and more about being digital gold. That is to say, as a store of value (definition: a commodity, asset, or money that retains its purchasing power over time) that is largely independent from government eyeballs and/or intervention. Proponents argue that bitcoin possesses and enhances some of the characteristics inherent in Gold’s store of value case: While both are durable, fungible (e.g., interchangeable), and scarce, bitcoin is more portable, easily verifiable, and divisible (paper money – more easily portable than gold and widely accepted than bitcoin – suffers from a lack of scarcity). Bitcoin is absolutely scarce, with a logarithmic supply schedule and a cap of 21 million. Of that 21 million, about 20 million have already been mined and multiple millions have been lost (as much as 3.8 million, according to a 2023 report from Bitcoin financial services firm Unchained Capital, although other estimates have ranged from 2 million to 6 million lost). The one area where bitcoin has yet to prove itself as a store of value is longevity; Gold has been a store of value for millennia, while bitcoin is not even old enough to drive a car.

Bitcoin as an investible asset. From an investment perspective, while Gold has lagged the stock market over the last fifty years, it has retained value in portfolio construction as a relatively uncorrelated asset that might rise in periods where stocks and bonds would fall (geopolitical instability, inflation). Gold is also widely accepted within the world of traditional finance. One popular argument for bitcoin’s price ascendance is that – if it were to at some point in the distant future replace Gold as wealth management’s pre-eminent store of value and relatively uncorrelated diversifier – demand would rise exponentially. Bitcoin also – as the largest and most held cryptocurrency – has embedded within it a call option on some technocentric future where blockchain technology is more widely utilized and/or bitcoin is more accepted as an actual means of exchange. Bitcoin’s value proposition and position in the larger world of investible assets is certainly unique and it has retained relevance for over a decade. No small feat. Further, the potential for a friendlier administration and regulatory clarity is rightfully perceived as a tailwind for an industry and asset that has been on the fringes of the mainstream for most of its existence.

Bitcoin’s drawbacks. Like gold, bitcoin’s lack of a tangible use-case (it’s a currency in which few transact and it doesn’t look as nice as gold in a bracelet) and its lack of any cash flows through which to calculate a value stand out as major weaknesses (not to mention the non-zero chance that another digital asset could supplant it as crypto’s premier store of value and/or innovation engine). To some, however, these weaknesses may appear to be strengths – bitcoin’s ambiguity can allow the justification of any price target or performance prediction, and many in its fervent fanbase take advantage. A cynic might argue that because cash flow on bitcoin can only be realized by selling for a price higher than one bought in (once again – no earnings, dividends, interest payments, etc.), current holders have every incentive to overstate the bull case and promote it aggressively. Furthermore, it is yet to be determined what a more crypto-friendly administration actually means. Regulatory clarity on cryptocurrencies does not mean “no regulation whatsoever.” Certainly, knowing the rules of the game creates a better environment for investment and would be a positive overall. But those expecting a wild west free-for-all might find themselves disappointed.

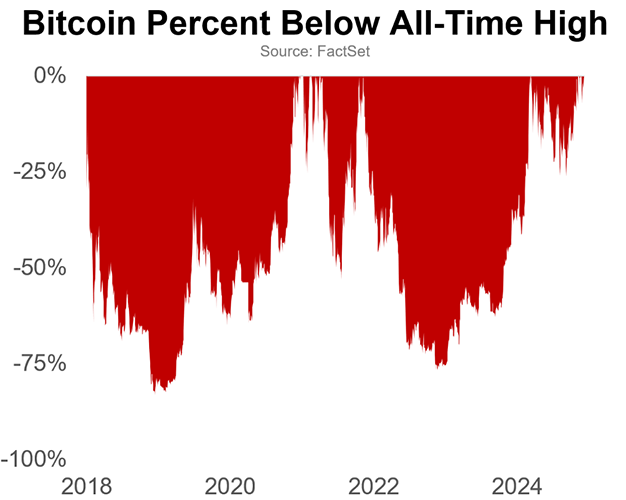

The ultimate FOMO investment. A loud fanbase and impressive returns have created an environment rife for FOMO (fear of missing out) investing. This is a dangerous place to be. While momentum investing is a popular and viable strategy, the tides can turn extremely quickly in volatile assets like bitcoin (even more so in smaller/less liquid coins). Bitcoin has seen four crashes of 50% or greater since 2017 (including two of 80%+), while the S&P 500 has only seen two in the last century. Stomaching the pain of market crashes is one of the most difficult parts of investing. Cash balances spiked following both the 2020 and 2022 bear markets, leaving trillions on the sidelines for the subsequent recovery rallies. And while the volatility of bitcoin may moderate somewhat as adoption grows, I’d expect it to remain above stock market levels for the foreseeable future. How will most investors handle the next 60% crash, especially if the primary reason they bought it in the first place was because they were promised high returns indefinitely?

Putting it all together. FOMO is not an investment strategy, and “because the price is going up” is not a sound justification for putting hard-earned dollars to work. Bitcoin is up roughly 1,300% in the last five years, and yet a larger share of investors say they’ve done worse than they expected investing in bitcoin than say they’ve done better. How could that be? Overtrading, speculation, chasing performance, gambling on less-proven coins in hopes of ever-higher returns, etc. Per Coinbase, the median time users hold Bitcoin before selling it or sending it to another account is just 89 days. While risky (and even speculative) assets could feasibly have a place in the portfolio of someone with a high risk tolerance, there’s a marked difference between investing and gambling. Or, as Warren Buffett says, “If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes.” In the end, anyone considering bitcoin should take into account the fundamental justification for the investment alone – and leave both the noise and euphoria of the current environment out of the equation.

Disclosures

Baird does not currently recommend the purchase of any cryptocurrencies, products that attempt to track cryptocurrencies, or cryptocurrency custodians. Baird does not custody Bitcoin or any other cryptocurrencies.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.