All That Matters: What Lies Ahead

To ring in 2025, Mike and Ross pull back to reflect on the market’s performance over recent years, and turn their heads to the proposed policies of the new presidential administration.

Perspective

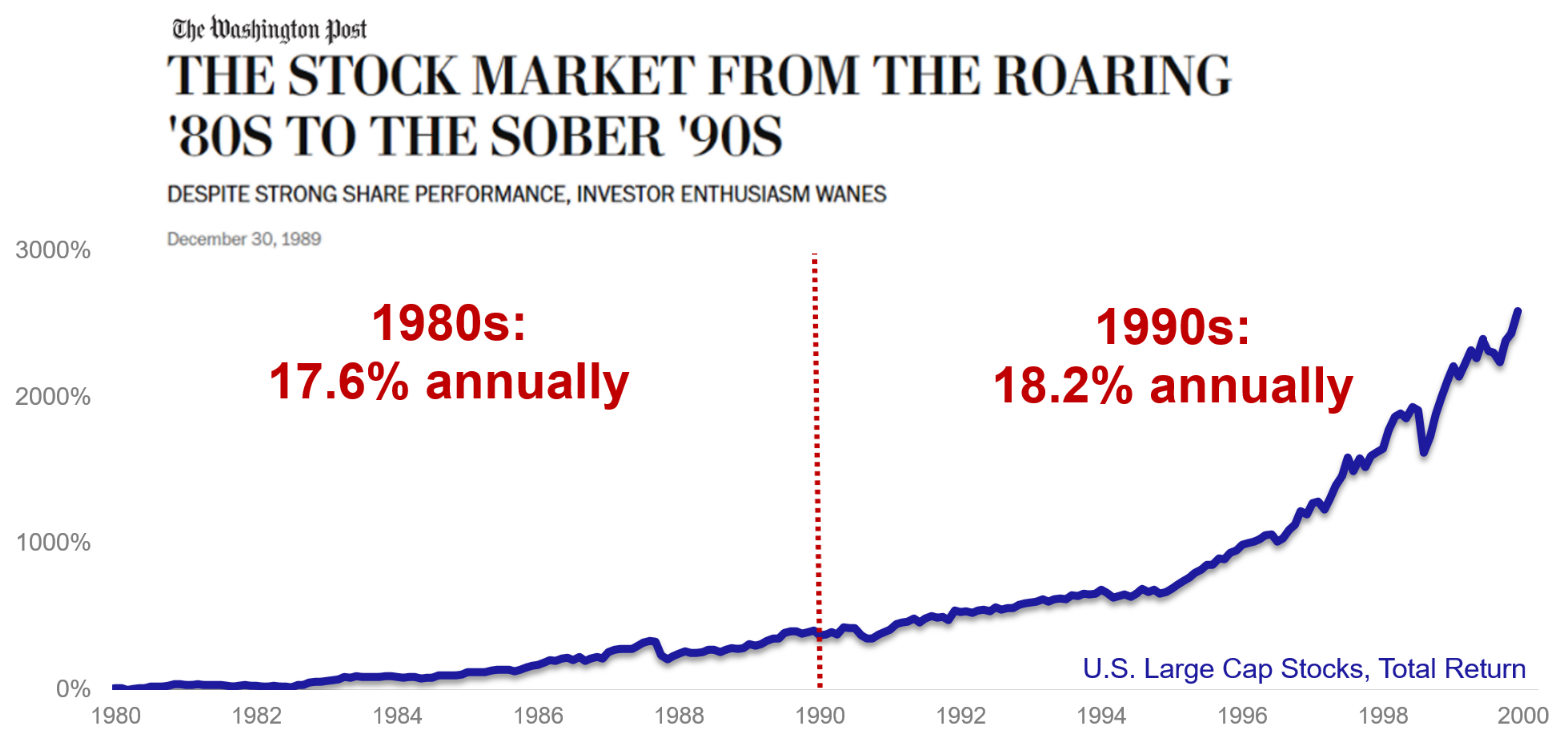

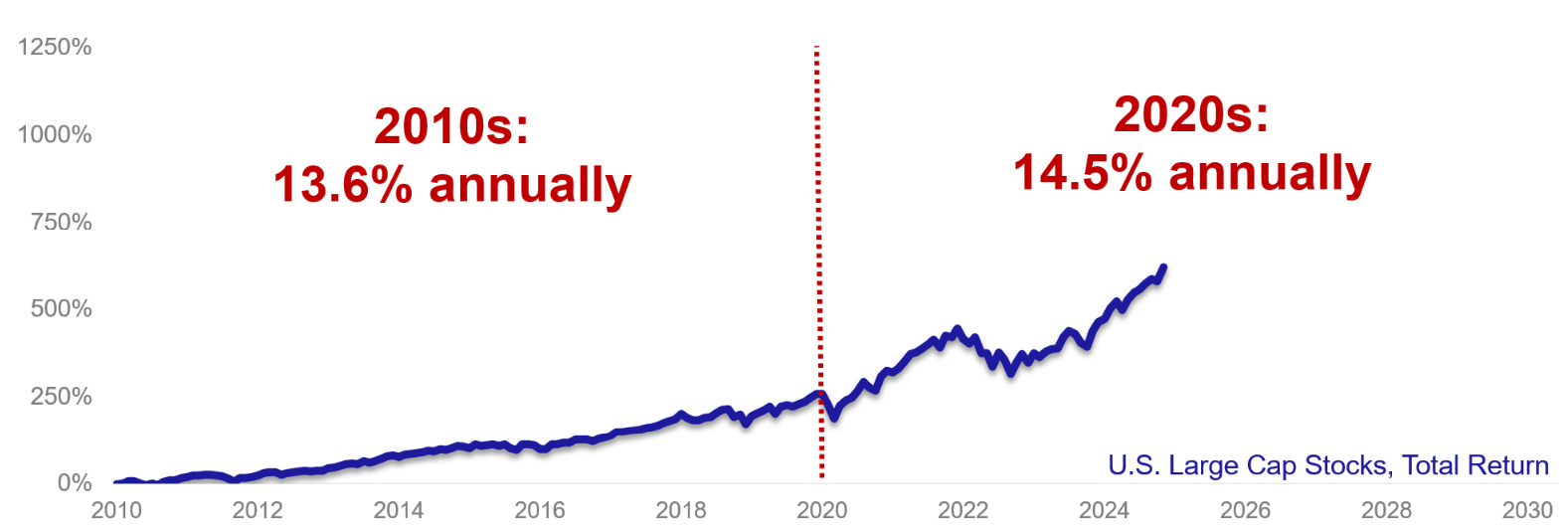

Mike: Something you and I have talked about is the bird’s eye view of the market’s performance, and how that influences investor mindsets. In the following chart, you can see how well the market has performed over the last four decades. At the end of the 80s, I suspect everyone was thinking that the 90s couldn’t be as good. And the decade turned out to be better! We ended up having an incredible 20-year period for the stock market.

Now let’s fast forward to the last 20 years. The 2010s was another great decade for the stock market; we had the second-best bull market of all time. And yet the 2020s is going even better: over the past four years, the S&P is up 100% and the typical 60 stock/40 bond portfolio is up 56%. These two examples show that the stock market doesn’t have to have a bad decade just because it had a good decade.

Ross: It’s important to remember that the market goes up more than it goes down. And while we see recessions and we see bear markets, the economy expands more than it contracts. The base state for the U.S. economy is economic growth through innovation. In the past five years, there have been plenty of topics that have been designed to scare people out of the market, intentionally or unintentionally: recession talk, elections, market volatility, et cetera. And despite all of that, we’re up 100% over that period. The first half of the 2020s have been a great time to be invested and to build wealth. You cannot be scared out of the market during these types of runs because they don’t last forever, and they’re significant wealth-building opportunities.

Returns

Ross: We just observed back-to-back 20% returns of the stock market. If you look at other instances of this over the past 75 years, you’ll see that the median return for year three after back-to-back 20%+ years is 13% – better than the market’s long-term average. Now, we know that past performance is no guarantee of future results, but we can use this data point to show that the market’s recent strength is not reason alone to get bearish in 2025. If something else has you worried we can talk about it, but the recent bull market should not be the reason you hold back. Historical data suggests we could actually be in the early stages of a bull market. The current bull market, which started in October of 2022, is up 70-75% over the last 27 months. The average bull market going back to the 1930s is 60 months and about 180%. If we’re using that as an indicator, we’re not even close to getting to what an average bull market looks like.

Mike: Could the stock market go down this year? Absolutely. We know the world is a crazy place and a lot can happen over the course of a year. And yet these are the times to be building wealth. History has shown that back-to-back 20% years are not a reason to be afraid at all. There’s always a risk over a shorter period of time, and yet when you look at the first half of this decade – even with COVID and a bear market – we are still outperforming the 2010s.

Policy Proposals

Mike: We have a new administration coming up, and clients have been asking about three hot policy topics: immigration, tariffs and tax proposals.

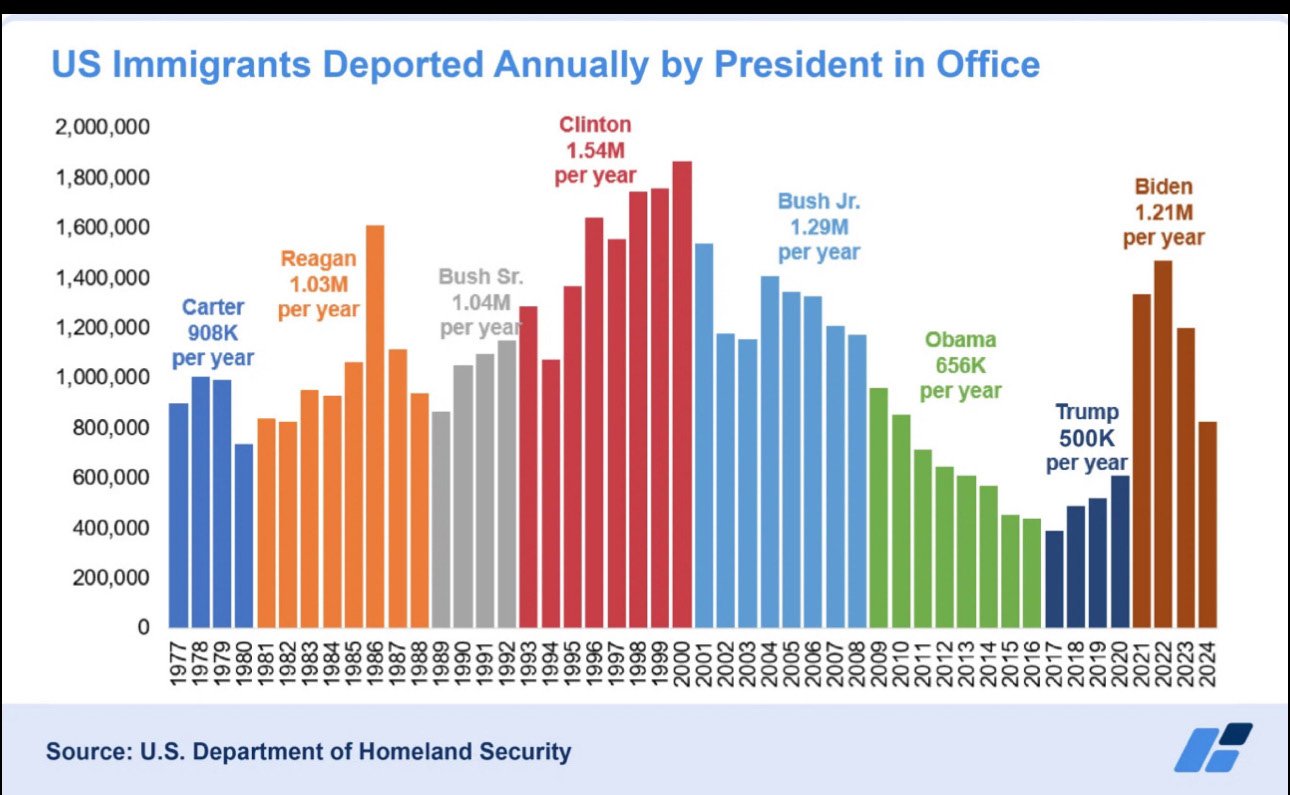

The question we continue to hear is, “Does immigration affect the stock market?” Before we dig into answering that, it’s worth taking a step back to look at the bigger picture. The United States has deported, on average, about a million people a year since the early 1980s. The number fluctuates a bit by year and by president, but it’s a significant number every year. But Ross, when it comes to the stock market, does immigration have an effect?

Ross: Yes it can, but I want to caution that what we’re talking about falls somewhere between campaign rhetoric and policy proposal. We know that policies often look very different after making their way through Congress or through agencies. Implementation can be a lot different than campaign promises. We observed this in President Trump’s first term, we saw it in President Biden’s term, and we’ve seen it through the course of history.

When it comes to immigration’s impact on the stock market, it’s worth looking at our current labor market. Generally in this country, there’s shortage of labor that can be attributed in part to demographics, and in part to a big drop in immigration during the pandemic. Whenever there’s a shortage of labor, it allows for the remaining workforce to ask for higher wages, which puts pressure on prices throughout the economy and leads to higher inflation and interest rates. If we have a tighter labor supply due to deporting available and willing workers, it could push up on wages.

Mike: The debate concerns a few key sectors in particular: construction, agriculture, and the service industry. We’ll be watching to see if policy – or policy concerns – is affecting those sectors of the markets.

The second policy topic is tariffs. If you remember 2016-2020, you’ll recall hearing seeing headlines of trade wars and tariffs all the time. President Trump would often tweet and threaten tariffs on a country, and we can expect to see more of that in the next four years. But does it have an impact on market inflation? Maybe, but it depends, and it also depends on what is currently a razor thin Republican majority in Congress.

Ross: There is literally as small as a margin in the House as you can get. The Republicans cannot lose one single vote. It’s true that some policy can take effect with executive action, but a lot of policy work is done through public negotiation and putting pressure on other countries. As you mentioned, the first Trump term was all about trade wars and tariffs, and yet inflation was 2.1% in Trump’s term before COVID hit. As far as the tariffs that got implemented and stayed implemented in his term, we never saw a huge impact on inflation. That’s not to say it couldn’t be different this time around, but tariffs weren’t inflationary in his first term.

Mike: It’s worth noting that the tariffs President Trump put in place were never removed by the Biden administration, and President Biden even added a few more tariffs related to high-tech computer components. Right now the headlines revolve around a lot of public discourse about negotiation positions – I think that’s the best way to think about it. While the policy debate and discourse plays out, try not to overreact to some of the fear-based headlines you see.

The third policy topic is taxes. Taxes are on everyone’s mind as the debate to extend the Tax Cuts and Jobs Act is negotiated, alongside other tax policies like the State and Local Tax (SALT). It’s another situation where we don’t know enough to make any sort of investment or planning decisions yet. That said, we have a supremely talented tax planning team, alongside Tim Steffen, that can help our clients respond to any changes once policy has been enacted.

Ross: This is a policy issue that must be resolved through Congress, and it’s going to require a lot of negotiation. You can expect to hear a lot of debate about potential legislation this year. While there isn’t enough information yet to respond, we’ll be ready to support our clients with the tools and solutions to plan accordingly.

Closing Thoughts

Ross: We’ve talked a great deal about policy proposals and rhetoric and the noise that comes with a new presidential administration. And since 2005, we’ve seen strong market gains in the first year of a new presidency, regardless of party. That includes Trump’s first term, which might have felt like a noisy year but was one of the quietest years in the stock market, with a 22% gain. Ultimately, investors should ignore the noise and focus on what matters. It’s precisely why we named the show All That Matters.

Mike: The reason we do this series is to get rid of the noise for our clients. If you watched us in 2024, I hope we helped to keep you on track and avoided talking about the nonsense. We’ll continue to deliver that in 2025, so please stay tuned as we watch events unfold together

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.