In the Markets Now: Attention, Please

With an unlimited buffet of information at our finger tips, what are the biggest risks to investors reaching their long-term goals?

The Pitfalls of The Attention Economy

In meeting with Baird financial advisors and their clients, I am often asked what I think the biggest risk to investors is. My answer is twofold, and almost certainly disappointing to those who want to hear about some impending calamity. First, the biggest risk to markets is that which is unforeseen, because the market isn’t already pricing it in. Think Covid-19 pandemic (or, on a smaller scale, the recent DeepSeek surprise). But the biggest risk to investors is that fear of uncertainty will keep them from participating in one of the greatest mass wealth creators ever known to mankind: the stock market.

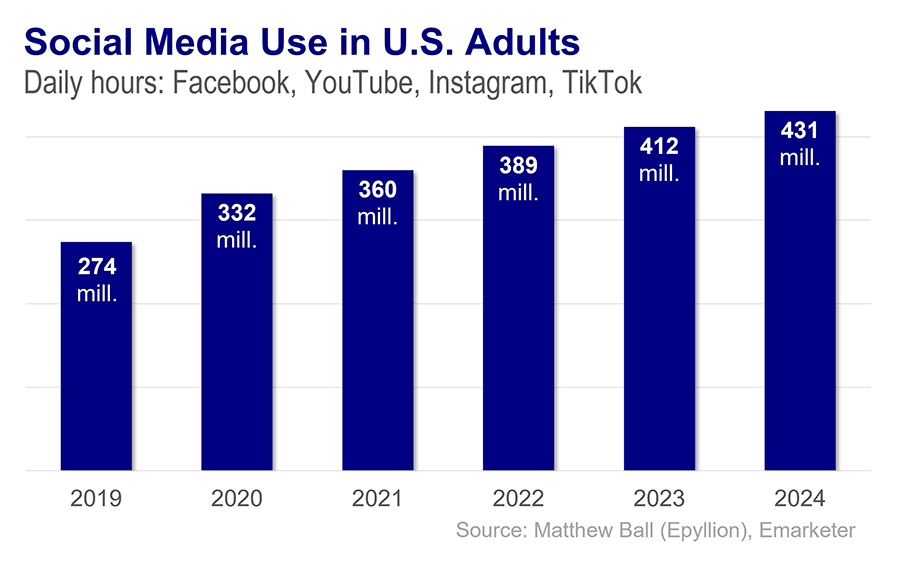

Since we can only control our own behavior and not what is unforeseen, let’s talk about investors and the fear of uncertainty. In his treatise on the state of video gaming, Matthew Ball presents a chart showing the growth in daily use of TikTok, Facebook, YouTube, and Instagram among U.S. adults—from about 275 million hours in 2019 to over 425 million by 2024. That is a roughly 50% increase in social media use across a period when the population grew by just 2%. We’re consuming more “information” than ever at a time when media are skewing increasingly negative in desperate competition for our eyeballs.

The irony is that an unlimited buffet of information—the modern internet contains about 90 quadrillion books’ worth of data—tends to result in a less informed consumer and, almost certainly, a worse investor. In fact, information hyperconsumers can often find it harder to retrieve and process relevant information (i.e., separate news from noise) from their available media, with digital overload increasingly recognized to have a dour impact on our mental health and investing outcomes alike. Just think of all the “reasons” to sell over the last few years: election volatility, recession predictions, geopolitical instability, bank failures, etc. And at every turn, selling would have left you poorer.

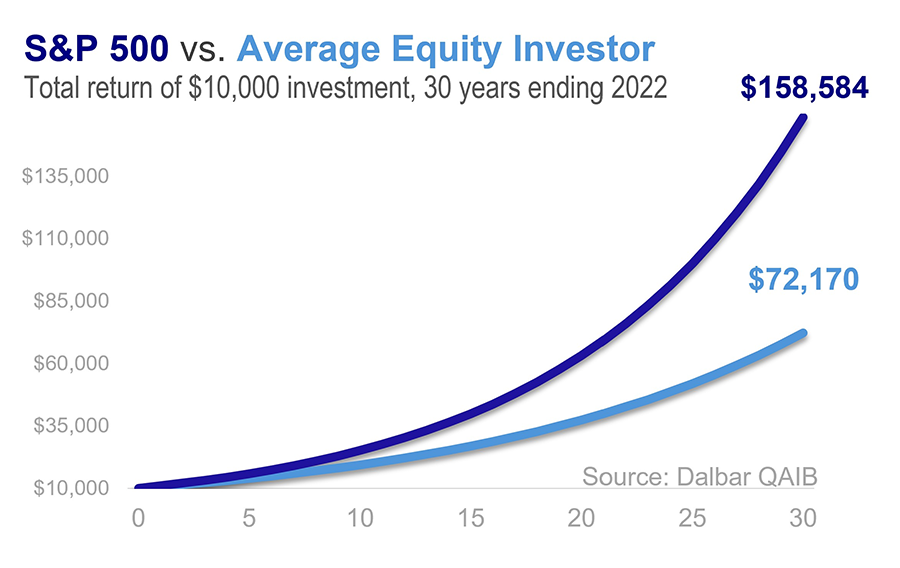

Financial services firm Dalbar notes that for the 30 years ending in 2022, the average equity investor earned 6.8% annually, while the S&P 500 returned 9.7%; our chart shows that effect on $10,000 invested. Dalbar, which analyzes purchases and sales of thousands of mutual funds to create an aggregate behavioral profile of the average investor, sums it up bluntly: “Emotional decisions hurt returns. Investors tend to sell out of investments during downturns and miss out on rebounds.” Now, human emotion’s influence on investing has existed for centuries (the Dutch Tulip Bubble saw tulip prices—yes, the flower—rise 20x before plunging 99% in 1637). But the negativity bias of modern media and the hypergrowth of the attention economy have turned a conundrum into a crisis. And not one demographic is spared.

A Wall Street maxim asserts that bull markets climb a wall of worry. Another postulates that bull markets are born on pessimism and grow on skepticism (before ending on euphoria). But the benefits of those bull markets can only be reaped if worry, pessimism, and skepticism don’t result in the investor surrendering first. To win, you’ve got to stay in the game.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.