In the Markets Now: Investing Lessons from Covid

Five years after the March 2020 Covid-19 market crash, we look back at some key lessons learned.

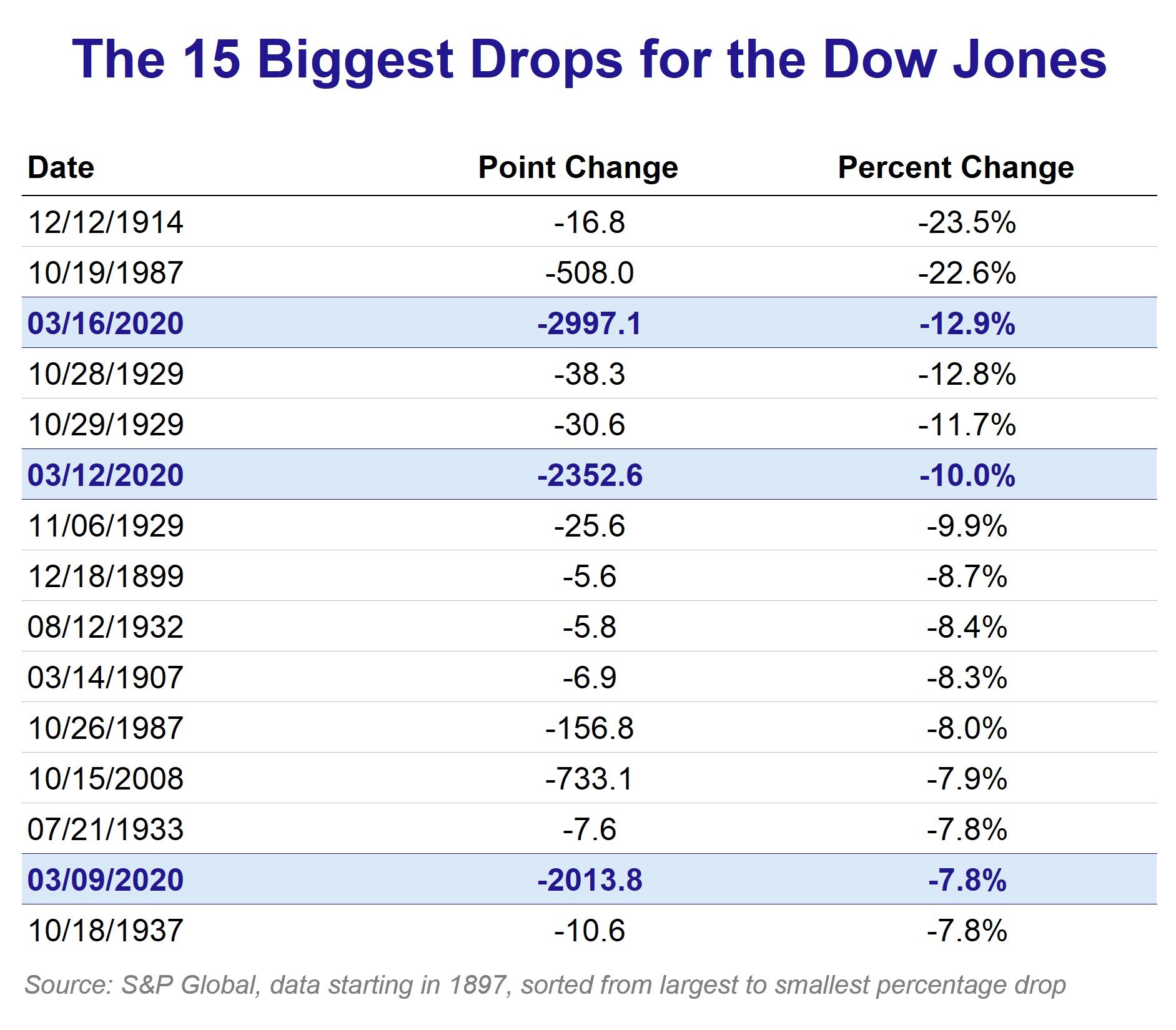

The market volatility wrought by the Covid-19 pandemic was unlike nearly anything we’d ever seen: the fastest bear market in almost 100 years, three of the worst days since 1897, and even—momentarily—negative oil prices.

With no shortage of uncertainty facing investors today, we humbly offer a few lessons we took from the chaos of five years ago.

- The biggest risks are the ones we don’t see coming. It isn’t that well understood risks like tariffs or higher interest rates can’t spur a selloff. But the once-a-decade, existential risks are the ones not being priced in by the market at all: a global pandemic, 9/11, Pearl Harbor, etc. In a way, this is reassuring (if you consider that the “risks” debated ad nauseum by the media are likely not the things that will ultimately crash markets). But uncertainty is also scary. Building a robust plan with contingencies for inevitable surprises is the only way to survive over the long-term and avoid the most existential risk of all: selling at the wrong moment.

- Bear markets bottom earlier than you think. The S&P 500 hit its nadir on Mar. 23, 2020—before the (first) multi-trillion-dollar stimulus bill, before unemployment peaked, and before any vaccine candidate was found to be effective. The stock market is a forward-looking machine and tends to see dawn on the horizon well ahead of most media or investors. In fact, stocks tend to rally strongly before a recession even ends. Seven of the last 8 U.S. recessions saw the S&P 500 rally strongly before the weakness concluded, with a median return of 30% from trough to recession-end.

- Market timing requires two right decisions. If you followed the early Covid-19 data out of China, you may have foreseen the possibility of a global pandemic and exited the market before it crashed. But to profit, you’d also have needed to put money back to work very quickly—and well before the health or economic situation were even remotely under control. From Feb. to Apr. 2020, assets in U.S. money market funds jumped from $4.0 trillion to $5.3 trillion as investors exited stocks in pursuit of relative safety. Most of that money stayed out of the market as the S&P 500 more than doubled over the 20 months from market low to the end of 2021.

- The stock market is not the economy. Since 1950, U.S. Real GDP growth—broad measure of economic activity—has been negative in only 9 years (all had recessions). But while one might expect such a result to spell doom for the market, the opposite was true: across those 9 calendar years, the S&P 500 was positive 8 times, and with a median return of 30%. While the stock market and the economy tend to move in the same direction over time (Josh Brown’s analogy is great), they often become quite disconnected during times of strain. This mismatch can unsettle investors, but it is critical to internalize given that bull market rallies almost always start during times of deep pessimism and economic weakness.

- Companies are alive. Putting money into a stock implies faith that the underlying company will grow their profits over time and, presumably, through all sorts of different economic backdrops, administrations, etc. Companies are not static—they are constantly adapting to be as profitable as possible in whatever environment they find themselves in. When the pandemic hit, corporate leaders adapted with work-from-home tools and carry-out cocktails. Not all individual companies or stocks will be homeruns, but investors are, over time, broadly rewarded by the profit motive inherent to capitalism.

- Control the controllable. Not just the obvious things like your asset allocation, your personal savings rate, and having a financial plan are important, but also how you react the next time markets (inevitably) drop. When the world feels especially chaotic, focusing on items within your control—the things that ultimately breed long-term financial success—is imperative.

A Wall Street maxim asserts that bull markets climb a wall of worry. Another postulates that bull markets are born on pessimism and grow on skepticism (before ending on euphoria). But the benefits of those bull markets can only be reaped if worry, pessimism, and skepticism don’t result in surrender. To win, you’ve got to stay in the game.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.