In the Markets Now: Spots of Weakness

In a world where an unlimited buffet of information exists at our finger tips, In the Markets Now covers the need-to-know in just one page.

What’s Driving Markets In 2025

Keeping up with the news lately has reminded me of one of my favorite lines from (all-time classic sitcom) 30 Rock, in which Liz Lemon exhaustedly says to her boss, “What a week, huh?” and he replies, “Lemon, it’s Wednesday.” That’s 2025 in a nutshell. And while the market’s drawdown is mild in itself (the S&P 500 is less than 5% down from its all-time high as of writing), the din of activity at home and abroad—amplified by an increasingly noisy and negative media/social media backdrop—is clearly generating angst. Per the American Association of Individual Investor’s widely-followed weekly survey, over 60% of investors today identify as “bearish,” the highest level since the bull market began in October 2022 (and in fact, the highest level ever recorded for a market so near its all-time high). What a year, huh? Ross, it’s March.

So, what gives? Tariffs and DOGE have grabbed headlines, but recent market weakness is as much, if not more, about economic growth. The U.S. avoided a widely-expected recession in 2023 on the back of a robust labor market and strong consumer spending—and that “soft landing” is a leg that the current bull market stands on. But recent data have called these supportive conditions into question at the macro level (see: the recent pop in initial unemployment claims, etc.) and at a company level (see: Walmart’s cautious consumer update). As a result of downside surprises to key data, the Atlanta Fed’s GDP estimate for Q1 economic growth is now negative.

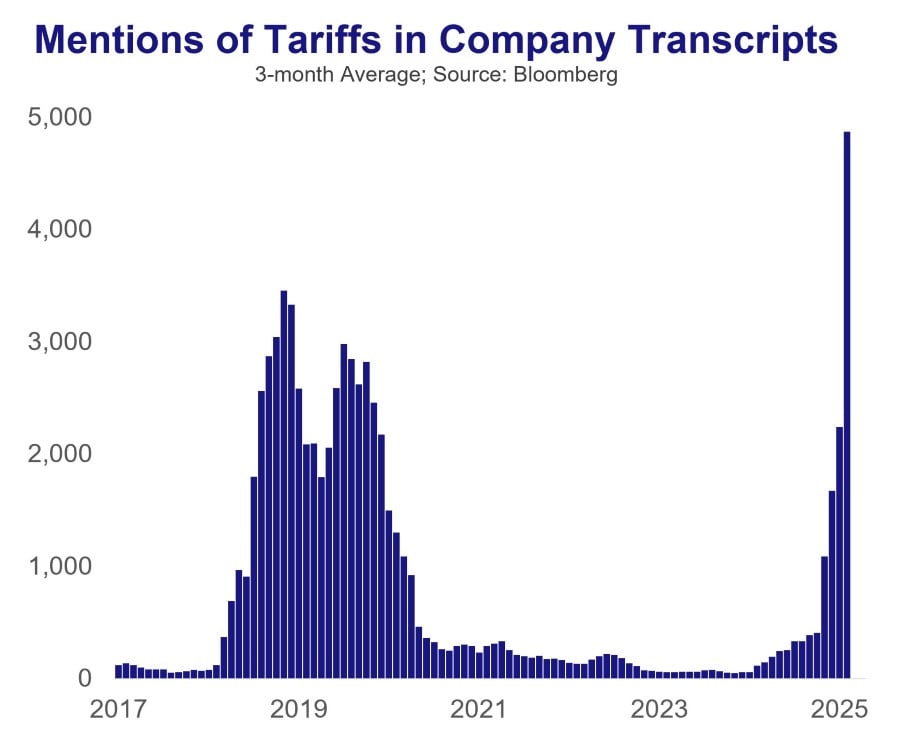

At the macro level, a softening backdrop leaves the economy more susceptible to shocks from Washington. Policy uncertainty is historically high, and companies are increasingly identifying tariff ambiguity as a hindrance to business investment and hiring (see: January’s manufacturing PMI commentary). U.S. firms could likely weather higher tariffs on their own (though raising taxes, in a vacuum, will compress profits), but lack of clarity on policy specifics is starting to weigh on the sort of company spending/hiring decisions that drive long-term economic growth. Stocks are starting to reflect that.

And at the corporate level, post-earnings pullbacks by Nvidia and other Big Tech names have dragged the cap-weighted S&P 500 index below its equal-weighted counterpart (aka “the average stock”). Despite solid takeaways from Nvidia’s recent earnings report, there are still lingering questions about the near-term positive impact of artificial intelligence tools for the broader economy and bottom-line profitability.

Context is important, however. The U.S. has still added more than 2 million jobs over the last 12 months, consumer spending remains on solid ground, credit spreads are not signaling recession, and U.S. companies just wrapped up their best quarter of profit growth since 2021. As Strategas President Nicholas Bohnsack recently noted, the market remains in an uptrend and the growing dispersion between market winners and losers is to be expected at this stage of the economic cycle.

And while the current level of policy uncertainty might be unprecedented, stock market volatility is not. We’ve had a 5% or greater drawdown nearly every year over the last century (almost all of them in the context of an ongoing bull market), and the average intra-year pullback is ~15%. Rarely are these fatal. Further, if this bull market, which has run +73% in 29 months, ended tomorrow it would fall well short of the average bull (+178% over 60 months). The Wall Street maxim that bull markets climb a wall of worry suggests that the savvy investor should only pull back when other investors are broadly euphoric about the market outlook. It’s hard to argue that there’s widespread euphoria today. And while uncertainty may provide the footholds for the market to keep climbing the wall of worry, only the investors who stay in the game will reap the benefits.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.