In the Markets Now: The Reserve Currency

In a world where an unlimited buffet of information exists at our finger tips, In the Markets Now covers the need-to-know in two pages.

Scattered Thoughts on The Dollar’s Decline

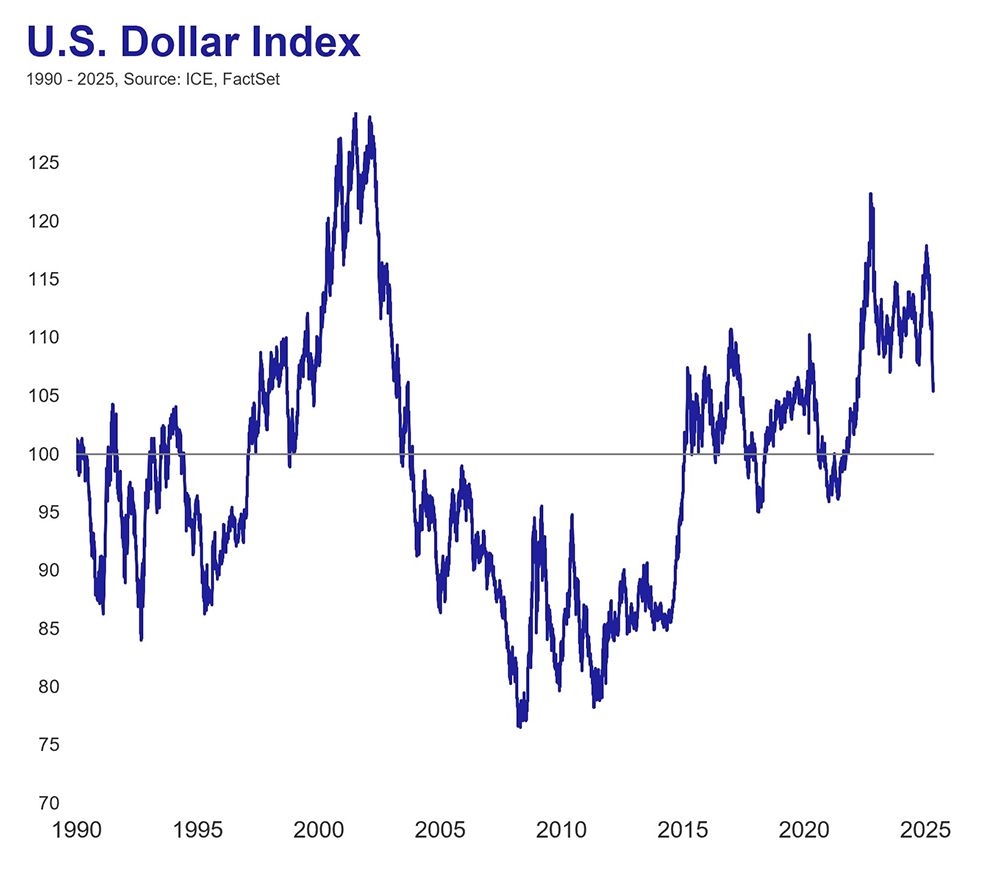

With the US dollar down 9% in 2025, concerns about its reserve currency status have again begun to burble. With the administration’s ongoing tariff enactment and dispute with the Federal Reserve, dollar weakness is perhaps unsurprising, especially after hitting a multi-year high in January. And while a slow diversification away from dollar dominance seems likely to continue – perhaps exacerbated by the current policy prescription and overall trend towards deglobalization ‒ it is my opinion that the lack of good alternatives (along with many of the things that America still does very well) will keep the dollar as the world’s dominant and reserve currency for the foreseeable future. Some quick-hitters below:

What makes a reserve currency?

A few critical factors from the US Treasury’s 2009 report to Congress:

- Size of the domestic economy. The US is the largest economy in the world by a sizeable margin, and growing.

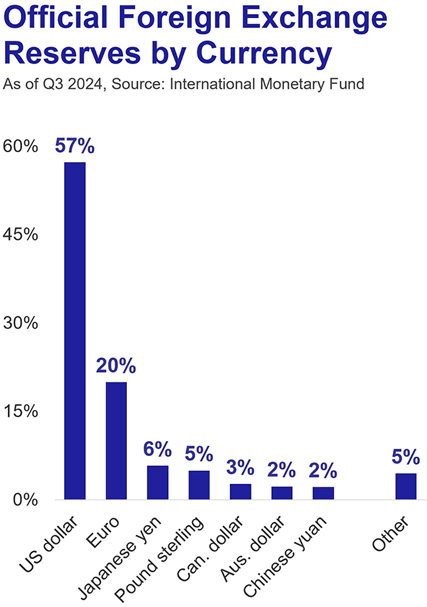

- Importance of the economy in international trade. The US dollar represents 54% of global export invoicing, 57% of official foreign exchange reserves, and is used in 88% of foreign exchange transactions. These percentages may shrink somewhat in a more multi-polar, less globalized world, but network effects will make it difficult for countries to exit the dollar or even to materially reduce exposure. Global financial infrastructure has been designed over the last several decades explicitly for widespread U.S. dollar usage (e.g., petrodollars), which reduces uncertainty and cost across all layers of global finance. This is not written in law but would be hugely difficult to upend in an interconnected world.

- The size, depth, and openness of financial markets, and the convertibility of the dollar. The US has the world’s largest bond market, largest stock market, and largest real estate market. Further, the US is considered one of the most financially open countries (considering things like capital controls). For comparison, using the methodology here, China, Russia, India, and Brazil sit near the bottom of the list. Using China as an example, the Fed writes, “the renminbi is not freely exchangeable, the Chinese capital account is not open, and investor confidence in Chinese institutions is relatively low. These factors all make the Chinese renminbi relatively unattractive for international investors.”

- The use of the dollar as a currency peg. Ilzetzki, Reinhart, and Rogoff estimate that 46% of global GDP is anchored to the US dollar by way of currency peg, more than double the next closest competitor (the euro).

- Domestic economic policies. This is the big question given concerns about the ongoing trade war(s), status of the Fed’s independence, and worries about America’s debt and deficit (among other things). Time will tell on those fronts, but a lot can still go right. The U.S. is a business-friendly country (e.g., low corporate tax rate, easy access to capital, large consumer base), and federal debt levels, while high in absolute terms, are not so different from many would-be competitors in terms of debt-to-GDP and debt-to-income. Inflation has come down markedly, jobs have been abundant (+8.1 million payrolls added in the last 3 years), and economic growth has been above peers post-pandemic. In my view, it is far too early to declare the death of American economic exceptionalism.

What else to consider?

A weaker dollar does not mean loss of reserve status. Currencies appreciate and depreciate based on many economic factors – interest rates, inflation, fiscal health, etc. But a weakening dollar should not be equated with loss of reserve currency status (e.g., from July 2001 to April 2008, the U.S. Dollar Index fell over 40% and the dollar remained solidly the global reserve currency). Past that, U.S. companies with operations abroad often welcome a weaker dollar, as foreign profits can be converted back into more dollars to pay out as a dividend or reinvest in the business. The current administration has even at times advocated for a weaker dollar to make American exports more competitive on the global market. All in, since 1988, a falling dollar has been associated with better stock market returns – in the U.S. and abroad. The recent move lower has been sharp and somewhat concerning, but it’s worth remembering that a perpetually strengthening U.S. dollar would not be a positive outcome, either.

Reserve status is not a prerequisite for equity strength. Ask the question, “if the US were to lose reserve status over time, what would it mean for the companies I own stock in?” Plenty of international companies have done well without the benefit of their home country having reserve currency status, and plenty of U.S. companies have failed despite it; the creation and ascendence of Apple was not dependent on the dollar being the global reserve currency, nor was the rise of Samsung inhibited because its home currency is the Korean won.

Stocks are ownership shares in actual companies and appreciate in value as those companies grow their profits. If you own stock, you own that incentive. A change in the dollar’s reserve currency status would alter many things, but it would not change the profit motive inherent to companies operating in a free market capitalist system.

This story will persist in perpetuity. The dollar’s status has been called into question at countless moments in the last 50 years, and the news cycle has rarely failed to enthusiastically engage in the debate. There’s nothing more powerful than a good story, and the narrative of foreign actors conspiring to unseat American power is the perfect lever to generate engagement. As far back as the 1970s, OPEC nations were threatening to cut links with the dollar (to little avail). That is not to say there aren’t kernels of truth in most versions of this story, and the current administration’s goal to rework the global trading system will undoubtedly change some longstanding truths held by investors. But the death of the dollar has been predicted more times than I can count. As long as the dollar remains entrenched as the reserve currency, the stories about its imminent demise will persist. Buckle up.

Conclusion

Charlie Munger once said, "Show me the incentive, and I'll show you the outcome." For many countries – both allies and adversaries – the widespread influence of the U.S. dollar sows anxiety. It is an economic variable out of their control, and leaves them more vulnerable to things like punitive tariff policy or outright currency weaponization (e.g., the sanctions levied against Russia after their invasion of Ukraine in 2022). So, at this point in history, as the US takes a more isolationist stance to policymaking, the incentive for other countries is clearly – at minimum – to make sure they are well diversified in how they conduct business and store reserves (a broader basket of currencies, some Gold, perhaps even some cryptocurrency down the road).

But as noted above, other countries also benefit greatly from the United States’ deep and liquid capital markets, strong rule of law, massive consumer base, and willingness to run a deficit. Despite a multitude of headwinds, there are few currencies ‒ if any ‒ even close to ready to take up the mantle as the global financial system’s new reserve currency. While a weaker dollar might persist as the world works toward a new trade regime, the dollar’s reserve status looks to be on solid ground.

Disclosures

Baird does not currently recommend the purchase of any cryptocurrencies, products that attempt to track cryptocurrencies, or cryptocurrency custodians. Baird does not custody Bitcoin or any other cryptocurrencies.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.