In the Markets Now: Thoughts on the Market Selloff

In a world where an unlimited buffet of information is at our finger tips, In the Markets Now covers the need-to-know in just one page two pages.

While this is far from a comprehensive treatise on trade and tariffs, I wanted to share a few quick weekend thoughts on the market and economy as we continue to endure a historically volatile market.

On markets. Markets tend to bottom on bad news (e.g., the seriousness of Covid on Mar. 23, 2020), and with a capitulation event (i.e., a fear-based “sell everything” moment). Calling a bottom in real-time is difficult-to-impossible, but historic bearishness, fear-based selling, and record policy uncertainty is, oddly enough, a bullish cocktail for forward returns. Our partners at Strategas, a Baird Company, look for three conditions to mark a tactical low: sentiment extremes (check), indiscriminate selling (check), and capitulative price action (nearly check). Still, they note that markets rarely form a V-shaped recovery (sharp drop, sharp bounce), but tend to retest lows and ultimately go out with a whimper over a bang. A bounce could be in order, but volatility is likely to persist and getting back to the bull market trend is a much higher bar to clear.

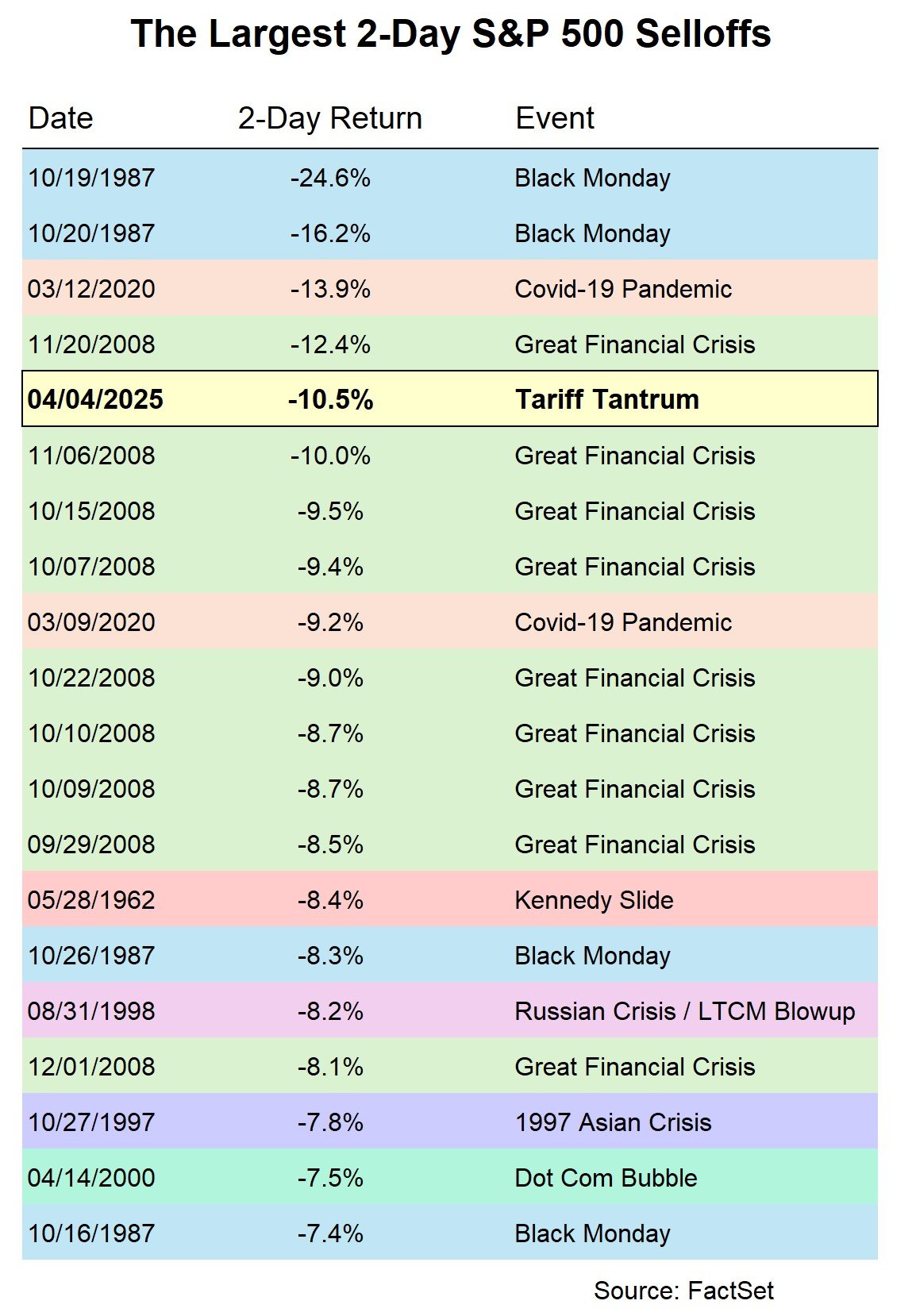

Rapid selloff. Over the last 75 years, there have only been three times that saw a greater two-day drop than the 10.5% crash we saw to end last week: Nov. 2008, Mar. 2020, and Oct. 1987 (Black Monday). All three were crisis-level events, and two featured deep recessions. The stock market vigilantes are out in force and are doing their best to force policymakers to act.

Volatility. Part of the oddity of investing around this selloff is its self-induced nature. If President Trump were to come out at any moment and announce pro-US, mega-trade deals with key allies, the market could skyrocket. By making policy with executive power, the bar for a renegotiation is much lower than it would be otherwise. So, as an investor, you could sell your stocks ‒ but you risk being on the wrong side of rapid and steep rally. During the Covid-19 bear market, most of the money that went to cash early in the selloff remained there ‒ and missed out on the market doubling over the next 18 months.

Shifts. Though the tariffs could be renegotiated and even removed in certain cases, some toothpaste cannot be put back in the tube. It’s possible there’s been some irreparable damage done to relationships with some trading partners, and the trend around the globe was already one of an increasingly fragmented and multipolar world. I think that this is a backdrop where international diversification becomes a more necessary tool for investors – the performance of various countries/trading blocs’ stock markets should be less correlated, and a weaker dollar sets up potential for international outperformance to continue.

Businesses. There’s also an uncertainty that could loom over the business community regardless of what comes next – to invest in long-term projects (factories, hiring people, etc.), you need to know your basic cost structure. If your import taxes fluctuate rapidly – and could continue to – the rational thing to do is not to make big investments. This could restrain medium-term economic growth even if this round of tariffs gets watered down in the coming days/months.

Speaking of businesses. Earnings season, the roughly six week period every quarter where most public companies report financial results and updates to shareholders, unofficially kicks off this week with some big banks reporting. It will be all-critical to listen closely to how corporate operators are planning to navigate the new tariff regime – are they negotiating with suppliers? Are they planning price hikes (and importantly, do they think their consumer is on solid-enough ground to absorb a price hike?) What other levers can they pull to navigate these stormy waters? High tariffs are not good for near-term profitability – period – but one of the things that hasn’t changed since April 2 is the profit motive inherent to a free enterprise capitalist system. Companies are alive, and they will adapt. But it will be worth listening closely to business leaders over the next six weeks to get a sense of how business leaders are thinking about this historic reorganization of global trade.

Shocks catalyze innovation. Big shocks to the system have a way of accelerating change, even if it’s not their intended effect (e.g., Covid-19: digitalization, flexible work). These tariffs are a big shock. If the goal of the policy is to level the trade playing field and bring manufacturing capacity back to the US, there is no doubt that artificial intelligence and robotics will play a role. In fact, facing higher costs to manufacture things in the US (labor, regulation, etc.), companies are incentivized to find out exactly what those roles are as quickly as possible. Getting more efficient in short order often involves massive technological adaption, and shocks force corporate operators to take steps they may not have otherwise been prepared to make.

Powering a revolution. Speaking of, artificial intelligence alone will challenge America’s electrical capacity (to say nothing of EVs, cryptocurrency, etc.) – now add on the policy objective to reshore as many critical supply chains and manufacturing hubs as possible, and you get to a simple conclusion: the US will need much, much more power. Early in a selloff, it’s hard to focus on anything other than the chaos. But chaos does breed opportunity, as well.

Monetary policy. The Fed is between a rock and a hard place. In 2018, the market sold off 20% into Christmas Eve on a combination of trade war fears and Federal Reserve hawkishness. So, we’ve seen big selloffs on tariff worries before (though they were far lesser in scale then). By early 2019, however, the Fed had changed its tone markedly, in large part due to equity market weakness (the “Powell pivot”), and markets were off to the races (S&P +31% in 2019). Today, the Fed has plenty of room to cut rates if the markets/economy necessitate it, but unfortunately for investors, they seem hesitant to talk about doing so out of fear that tariffs will spark a second wave of inflation. The ghosts of the 2021-22 spike in inflation haunt the Fed, and one wonders if they are going to be too late to respond if the economy weakens further. With all that said, the market now expects 4-5 rate cuts in 2025, up from two a few weeks back. With the fiscal side of the house on uncertain ground, at least monetary policy has a lever to pull if the economy weakens from here.

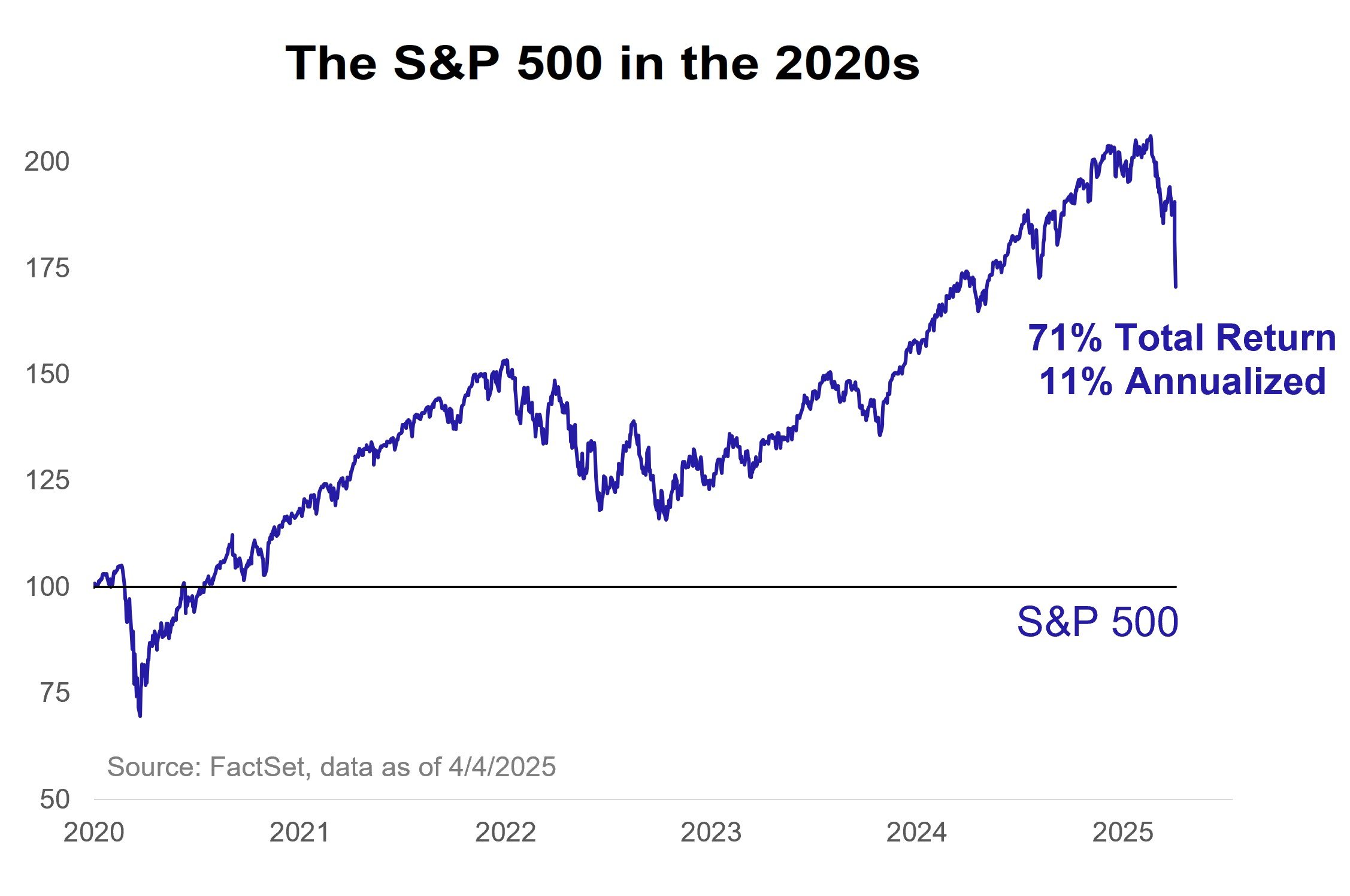

As of Friday’s close, the S&P was up 71% since the beginning of the 2020s

Source: FactSet

Fiscal policy. There will be legal challenges to the use of the International Emergency Economic Powers Act (IEEPA) to level broadscale tariffs via executive action, and it seems that Congress will also be pushing to have much more of a say in tariff policy going forward. All to say, there are multiple potential offramps to the tensions. And speaking of Congress, they will now be feeling even more pressure to get a big tax bill passed to help offset some of the near-term pain from tariffs. This is being underdiscussed right now (probably for good reason), but it’s extremely important going forward.

Average returns. Through the close on Apr. 4, the S&P 500 was up 71% this decade-to-date (roughly 11% annualized) nearly perfectly in line with the market’s long-term average. But while the S&P 500 has had an annualized return of 11% over the last 90 years, it almost never hits that mark in a given year (over that same time frame, there have been more calendar years with a 30%+ gain or loss than there have been years in the 5% to 15% range). The long-term story of steady growth looks entirely different from the short-term reality of boom and bust (and boom and bust and boom and bust). The market has endured through wars, pandemic, inflation, and more, but never in a straight line. Understanding that average rarely looks or feels average is critical to staying the course.

Perspective. In times of deep uncertainty, taking the long-term view can feel unsatisfying. We are human, we want to act NOW. But it is the perspective that the long-term view provides that's often necessary to persevere through chaotic times. So, let’s zoom out. Over the 50 years through the end of 2024, there have been: 374 days when the S&P 500 lost 2% or worse, 25 selloffs that reached -10% or worse (i.e., corrections), 11 selloffs of about -20% or worse (i.e., bear markets), 7 recessions. And over those 50 years, the S&P 500 is up ~32,400% (or, 12.3% annually). Uncertainty isn’t a hinderance to stock markets, it’s the reason that the potential for outsized returns exists in the first place. If not for volatility, there’d be no reason to expect strong returns year after year. Uncertainty is painful, but when it reigns, your reaction to it determines your success or failure.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.