The Road to November: Election Insights from Strategas

After a summer filled with groundbreaking events, the race for the presidency is extremely close. At a recent Baird event, Dan Clifton, Head of Policy Research at Strategas, shares a framework with which to view the election, and outlines the key issues that will impact clients in the years to come.

Three Elements to Analyze for the 2024 Election

As November approaches, the race for the White House is a virtual toss-up, as is which party will control Congress. At Strategas, we’ve built a three-part election framework to help better understand what’s happening. We look at whether the election is a referendum or a choice, we analyze key economic indicators, and then we observe what’s happening in the swing states.

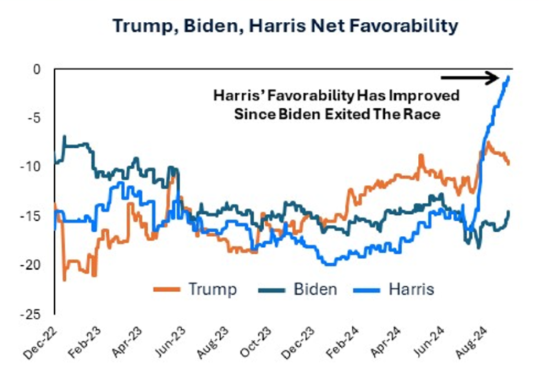

Is the election a referendum on the Biden-Harris administration, or is it a choice between Harris and Trump? To answer this question, we look to the presidential approval rating. When Biden dropped out of the race, we saw his rating go up – indicating that people simply did not want him to run again for president. The Trump campaign assumed that an unpopular president would simply be replaced with an unpopular vice president without much impact to the polls. Instead, as soon as Biden dropped out, we saw Harris’ approval rating start to go up. The Harris campaign has essentially made this race a choice between two candidates and not a referendum on the current administration. Unless something changes, this race will continue to be a choice. We expect that there will be another debate in mid-October, despite the Trump campaign currently declining another debate.

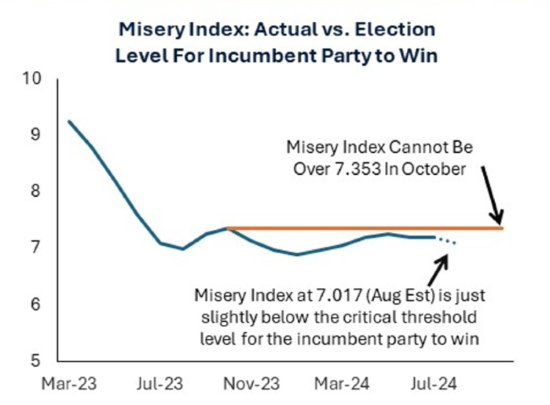

What do the economic indicators say? We look at two measures to understand the election. The first is the misery index, a combination of the inflation rate and unemployment rate. The misery index has predicted 15 of the past 16 election winners, and every winner since 1980. Our theory is that if the misery index is higher year over year, the incumbent party loses. If the misery index is lower year over year, the incumbent wins. And of course, in the 50-50 country we live in, we’re seeing the misery index fall on the 50-50 line. It has never been this close going into the presidential election before. We also note that gasoline prices are coming down significantly, and inflation is coming down – at least temporarily – faster than unemployment is moving higher. These trends are a key reason why Harris is still competitive in the race, and why Trump is having difficulty executing his argument against the strength of the economy.

With the misery index on the 50-50 line, we then look towards stock performance. What we’ve found is that the S&P 500 has predicted 20 of the past 24 elections. If stocks are higher in the last 90 days of the election, the incumbent party wins. If stocks are lower, it goes the other way. We combine this performance with the relative strength of the U.S. dollar, and we develop a forecast for where they land. Of course, we see that this forecast is split down the middle.

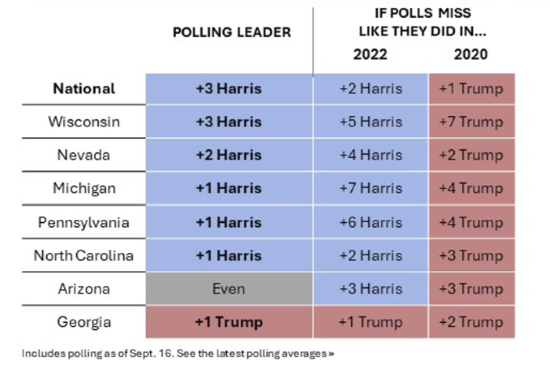

What are the swing states doing? With all of the economic indicators falling on the 50-50 line, the decider falls to the swing states. From November of last year to June of this year, Trump was overwhelmingly ahead in the swing state polling. In 2016, Trump never led in swing state polls in these states, which makes this unusual. But when Harris entered the race, Trump’s swing state lead collapsed. There’s about a two-point swing in the polls for Trump at the moment, though that number continues to decline after the September 10 debate.

It's worth noting the change in polling after Robert F. Kennedy’s endorsement of Trump in late August. While the majority of media outlets reported it as a minor development, our team at Strategas saw a different story. Trump is losing when looking at the five-candidate polling, but the two-candidate polling shows Trump as leading. This tells us that RFK was pulling more votes away from Trump than Harris, and that his endorsement has improved Trump’s standing in the swing states since it was announced.

We should also analyze the polling error data for these swing states. If you apply the 2020 error for Trump’s numbers, he wins every single swing state, even in the polls he’s losing right now. If you apply the polling error of 2022, Trump loses almost every swing state. Nobody knows if this year will mimic 2022 or 2020, but it’s likely that we’re sitting somewhere in between.

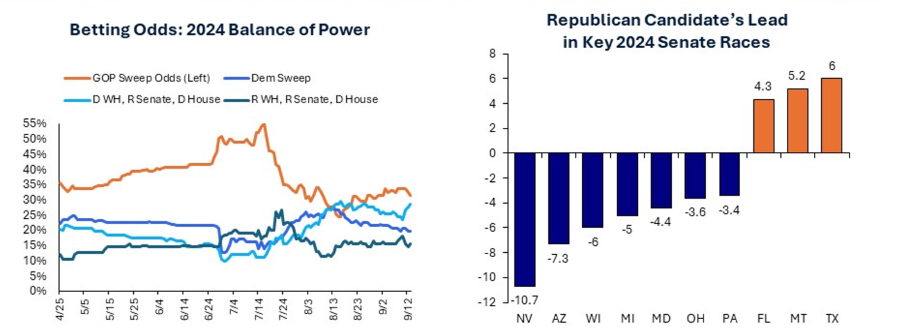

When it comes to the congressional races, we believe there is a real chance that the Democrats take the House of Representatives away from Republican control, and the Republicans take the Senate away from the Democrats. The historical significance of this is incredible: it has never happened in the modern U.S. political system and it’s extremely likely. The Democrats are likely to end with a five or six seat majority in the house, and the Republicans are expected to end with a 1 or 2 seat majority in the Senate.

What It Means for You

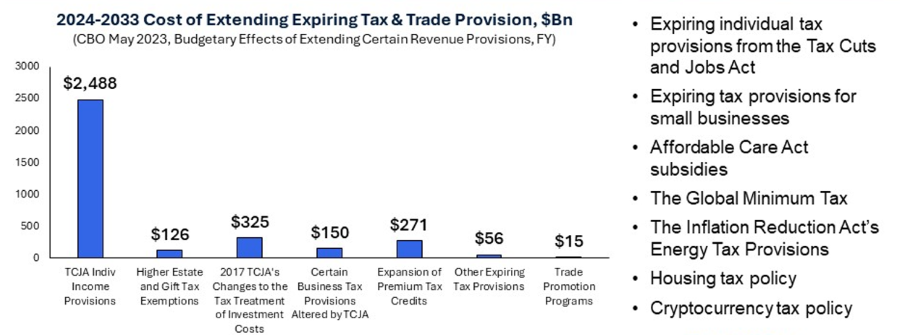

The election is a precursor to reorganizing the U.S. tax code by the end of 2025. Next year will be more important for tax policy than any other year, with the exception of 1913 when we created the income tax. We’re currently facing $4 trillion of tax cuts that are expiring at the end of 2025, as well as a $2 trillion budget deficit. If the government chooses not to intervene, we will see an increase in the income tax rates, a return of the Alternative Minimum Tax, a halving of the standard deduction and child tax credit, as well as significant decrease in the estate tax exemption.

Both candidates have a plan for how they’re going to resolve this, with implications that can impact individuals significantly. While it may feel like there’s plenty of time to respond, we’ve seen in history that these significant tax changes can create such a demand for planning and appraising services that you may not get the support you need. If you are not meeting with your Baird Financial Advisor now, this is the time to do it to ensure all of your paperwork and planning is up to date. Our motto is, “be prepared, and work with your Baird advisor to be able to respond to any situation.”

The last point to make is related to our outlook for the country. There is a lot of polarization in our country. But what I’ve observed on the ground in Washington is more and more cooperation between progressives and conservatives, particularly on foreign affairs issues. The threat of China is beginning to rally our country together and help us define a common interest. In the past, we had common foreign enemies, but after the Berlin Wall fell, we didn’t have anything to fight for globally; Democrats and Republicans became the main opponent. The more that China challenges the U.S., the more you’ll see our parties unifying to ensure our country’s national security is prepared, and that economic development is at home. I’m more bullish on America than I have ever been, despite all of this polarization. And while the next few months may be increasingly volatile, our long-term trajectory as a country is the right one, and I’m confident that America is going to take on our challengers and continue to be the greatest economy in the world.

This content is for informational and educational purposes only and is not sufficient upon which to base an investment, tax or legal decision. Your situation is fact dependent and you should seek additional professional advice related to your unique situation. All investments carry a level of risk, including loss of principal and past performance is not a guarantee of future results. An investment cannot be made directly in an index. The opinions expressed are those of the speakers and are subject to change.

Strategas Securities, LLC is a registered broker-dealer and FINRA member firm, as well as an SEC-registered investment advisor. It is affiliated with Strategas Asset Management, LLC, an SEC-registered investment advisor. Strategas Securities, LLC, is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), a broker-dealer and FINRA member firm, although the two firms conduct separate and distinct businesses.