Washington Policy Research – December 16, 2021

The legislative process has continued to lead to modifications to President Biden’s spending plan.

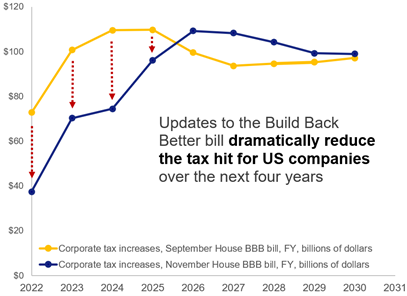

Last month we wrote about how political pressure forced changes to planned tax increases on high-net worth individuals, but important changes have also been made on corporate taxes. In September, the House of Representatives proposed raising the corporate tax rate to 26.5% from 21.0%, raising taxes on US multinationals’ overseas income to 15.0%, and implementing a handful of other tax increases that would go into effect at the start of 2022. However, a revised plan passed by the House in November removes the corporate tax rate increase entirely, pushes the tax on US multinationals out to 2023, creates a new 15.0% tax on US companies (also effective in 2023), and imposes a new 1.0% tax on share buybacks.

Corporate tax changes would lower the S&P 500 earnings hit to less than 1% (from 4%).

The biggest change on the corporate side is replacing an increase in the corporate tax rate with a 15.0% minimum tax on companies with book profits over $1 million. Congress tried something similar in 1986 but repealed the change just three years later. A minimum tax punishes firms for making pension contributions and/or capital expenditures. The latest Senate draft has removed the taxation of pensions and delays implementation until 2023 to work out the quirks. In addition, taxes on US multinationals are being delayed until 2023 so that other countries can bring their tax codes into compliance with the OECD global tax negotiations. The net effect of these changes nearly wipes out the previously estimated 4.0% hit to 2022 S&P 500 earnings, and also reduces the hit in 2023 and 2024.

Small businesses will still face a 3.8% tax starting in 2022.

Corporate taxpayers will mostly be spared tax increases in 2022, but small businesses that pay the individual income tax could face a new 3.8% tax for those with taxable income over $400k single and $500k married. Starting in 2013, a new 3.8% tax was applied on capital gains and dividend income for Medicare as part of President Obama’s Affordable Care Act (ACA). The House-passed bill and the Senate proposal both apply that new 3.8% tax to small business income with an effective date of January 1, 2022. Congress is struggling to get the legislation passed before the end of this year, but this change could be enacted early next year and be applied retroactively to January 1, 2022.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2020 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.