All That Matters in 2024

January Wealth Strategies

With a new year (and especially an election year) comes a fresh economic outlook. In our January Wealth Strategies Webinar, PWM Market Strategist Mike Antonelli and Investment Strategy Analyst Ross Mayfield share key notes to keep in mind when crafting your financial and investment plans for 2024.

Michael Antonelli

PWM Market Strategist

Ross Mayfield

Investment Strategy Analyst

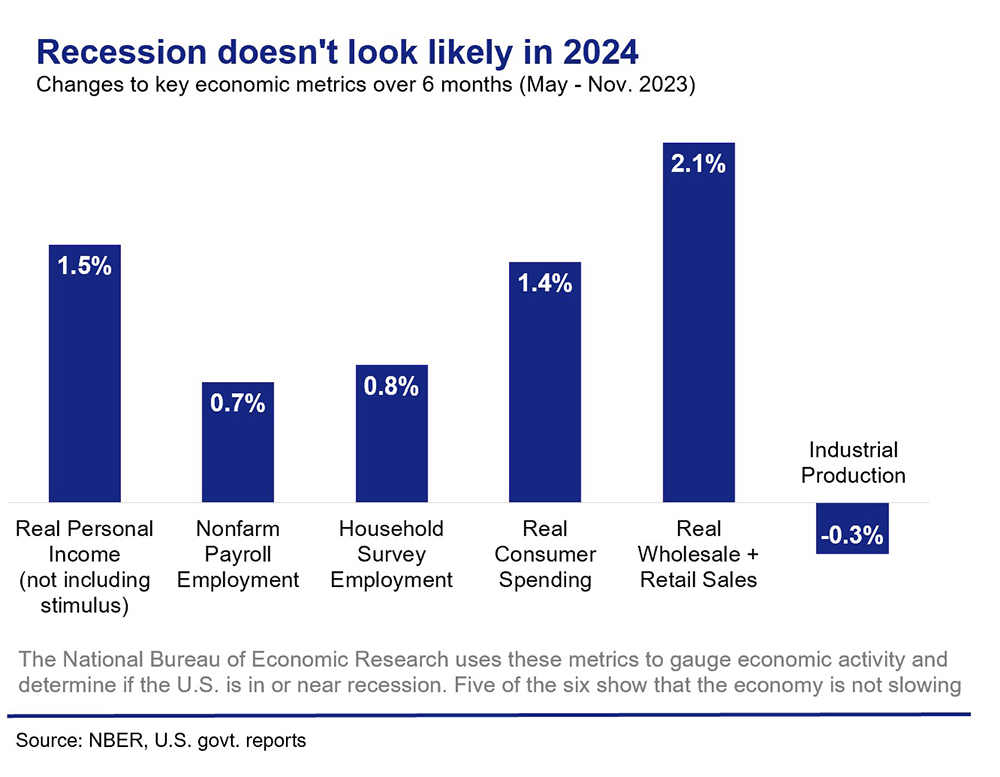

Are We on the Verge of a Recession?

Despite the intimidating news headlines and a worrisome general buzz around the economy’s current state, Mike and Ross remain confident that the U.S. is not headed in the direction of a recession near-term. Of the six diverse indicators of the economy’s health that the National Bureau of Economic Research uses to determine whether we are in a recession, five had a positive percentage change heading into year-end. This could always change, but as of now, the indications look solid.

And while it’s true that U.S. consumers are in $20 trillion of debt, they also have $171 trillion in assets (that’s eight times the amount of liabilities!). Not only do the assets heavily outweigh the liabilities, but over two-thirds of the total debt is from mortgages – which are considered “good debt” because they are used for high-quality assets and have low interest rates. The outlook for the U.S. consumer looks generally positive.

Is Inflation Receding?

The numbers tell us that the worst may be behind us. After reaching a low of 0.1% in May of 2020, inflation soared to 9.1% in June of 2022. Currently, inflation is back down to 3.4%. And while higher prices are not an ideal situation for anyone, in aggregate, wages have actually kept up with inflation – so much so that wage growth is slightly ahead of overall inflation since the Covid-19 pandemic began.

So if inflation is receding, is the Fed going to cut interest rates in 2024? Mike and Ross think so, but while peak interest and mortgage rates may be over with, the inflated prices of goods and services aren’t likely to go down from here. And for better or worse, we’ve seen this throughout history. The fast-food meal choices might not drop back down to $5, but as time goes by, people will get used to the higher prices – which may be easier to do as wages continue to increase. In fact, one of the factors keeping us out of a recession is a booming job market that is defying all odds. Unemployment in the U.S. is as low as it’s been since the 1960s, showing that people are finding their way back to the pre-Covid “normal.”

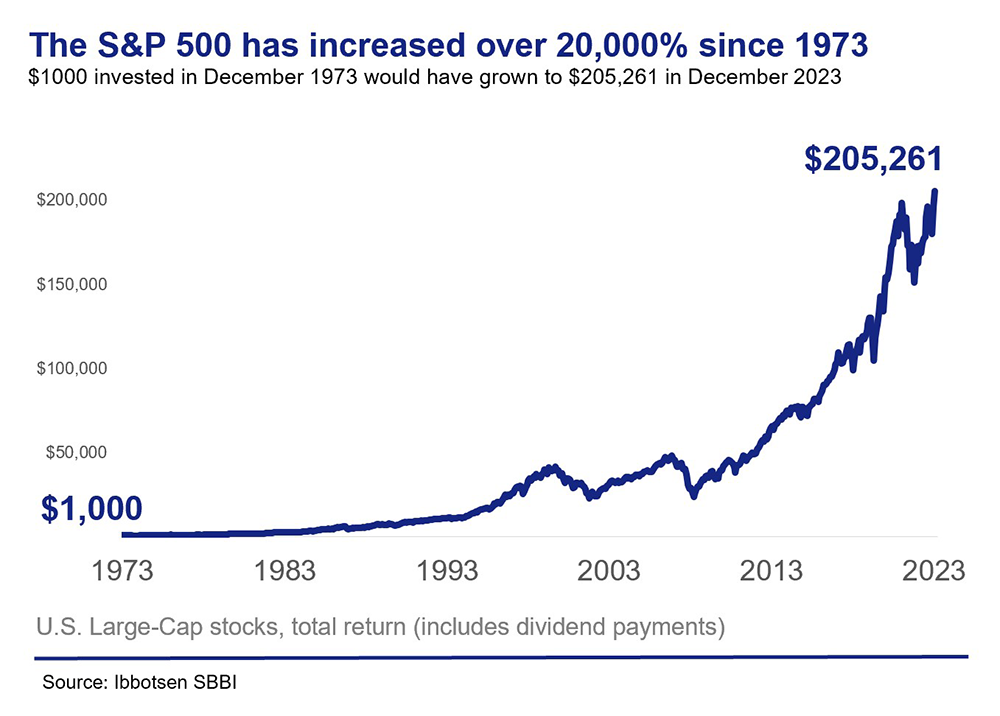

Big 2023, Big Long-Term Gains

The S&P 500 stock market index has increased 26% since 1973. $1,000 invested in December of 1973 would be $205,261 now.

What Can We Expect To See From the Market This Year?

Mike and Ross see 2024 as a year with less economic volatility. When Covid first struck the economy, it created large waves of volatility – but as time has passed, those waves have slowly become smaller and smaller, leading towards eventual economic consistency. With the economy stabilizing, the Fed is predicted to start cutting interest rates at some point in 2024 – a prospect that is fueling investor optimism and could lead to a market rally this year.

Mike and Ross see 2024 as a year with less economic volatility. When Covid first struck the economy, it created large waves of volatility – but as time has passed, those waves have slowly become smaller and smaller, leading towards eventual economic consistency. With the economy stabilizing, the Fed is predicted to start cutting interest rates at some point in 2024 – a prospect that is fueling investor optimism and could lead to a market rally this year.

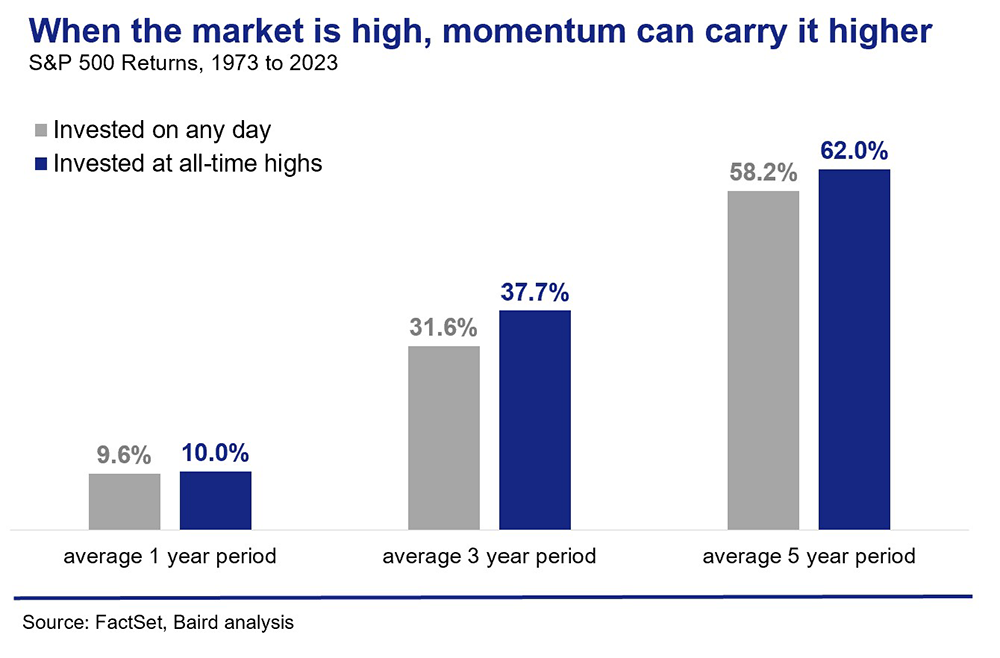

If the stock market does increase enough to put us in a bull market, don’t be afraid to participate in it – even if stocks are pushing past their all-time highs. The evidence of history shows that stocks that hit record highs often go on to even greater heights. In a bull market there is likely to be short-term dips and spikes in stock prices, but this market volatility is like turbulence and should not discourage long-term investors.

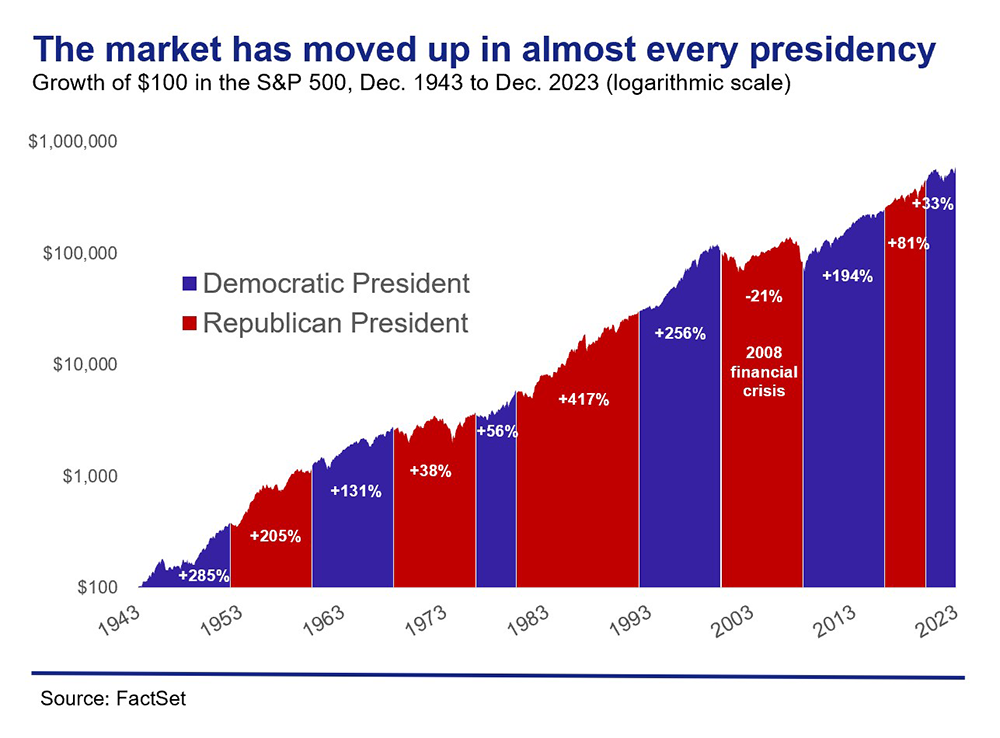

How Do Politics Impact the Market?

The short answer? They don’t. The market’s trend is vastly apolitical, and while we are in an election year, history shows that the growth of the market has remained steady regardless of the party affiliation of the president. For example, while the 1970s and 1980s did have large market growth, it isn’t attributed to the presidents of the time. Rather, it’s attributed to the creation of computers and big-name companies like Starbucks and Walmart. It’s important to remember that these companies and innovations are the drivers of the market – not the party in power. And when you invest, you’re not investing in whoever happens to be sitting in the White House – you’re investing in the companies themselves.

The short answer? They don’t. The market’s trend is vastly apolitical, and while we are in an election year, history shows that the growth of the market has remained steady regardless of the party affiliation of the president. For example, while the 1970s and 1980s did have large market growth, it isn’t attributed to the presidents of the time. Rather, it’s attributed to the creation of computers and big-name companies like Starbucks and Walmart. It’s important to remember that these companies and innovations are the drivers of the market – not the party in power. And when you invest, you’re not investing in whoever happens to be sitting in the White House – you’re investing in the companies themselves.

And while the market has seen steady growth from the beginning to the end of each presidency (aside from the 2008 recession), every president since Herbert Hoover has also seen a double-digit decline in the Dow Jones at some point within their term. These temporary setbacks are usually triggered by world events that happened to occur while they were in office.

How Is This Re-Election Year Going to Impact the Market?

Re-election years have historically been correlated with positive market returns. Since 1944, the stock market has been up in every year where a president has run for re-election (13–14% on average). Typically, we can expect to see volatility in the first quarter beginning around Super Tuesday, but see gains at the back end of the year. Fiscal policy plays an important role here. Presidents who are up for re-election try to turn the knobs (such as giving tax breaks and stimulus packages) to keep the S&P performance positive, explaining why re-election years tend to be positive for the market.

For further discussion around what 2024 has in store for the U.S. market and economy, check out January’s Wealth Strategies video. If you have questions or want to discuss how 2024 will impact your personal situation, please reach out to your Baird Financial Advisor. Our entire series of Wealth Strategies webinars is available online.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.