President Biden’s Proposed Tax Changes

A few days after his State of the Union address, President Biden released his FY 2025 budget, outlining his policy priorities. While the provisions are unlikely to become law this year, they do provide a roadmap for Biden’s policy to pay for extending more than $3 trillion of expiring tax cuts at the end of 2025.

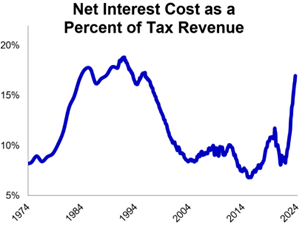

All of the individual tax changes enacted in 2017 as part of the Tax Cuts and Jobs Act expire at the end of 2025. While both parties would like to extend the middle-class tax cuts, policymakers will have to consider the cost of doing so now that interest costs are much higher (making the cuts more difficult to extend without offsetting the cost). The outcome of the November elections will be key to how the debate is resolved. Democrats are likely to push for higher taxes while Republicans will look to cut spending and pare back renewable energy tax credits that were part of the Inflation Reduction Act. Politically, we expect a divided Congress, making the most extreme tax increases unlikely to be enacted. However, tax changes could be on the table even with Republicans in control in Washington, given the US fiscal situation and the strains on the US deficit. President Biden used his FY 2025 budget to propose tax changes that would impact high-income individuals and corporations, including:

All of the individual tax changes enacted in 2017 as part of the Tax Cuts and Jobs Act expire at the end of 2025. While both parties would like to extend the middle-class tax cuts, policymakers will have to consider the cost of doing so now that interest costs are much higher (making the cuts more difficult to extend without offsetting the cost). The outcome of the November elections will be key to how the debate is resolved. Democrats are likely to push for higher taxes while Republicans will look to cut spending and pare back renewable energy tax credits that were part of the Inflation Reduction Act. Politically, we expect a divided Congress, making the most extreme tax increases unlikely to be enacted. However, tax changes could be on the table even with Republicans in control in Washington, given the US fiscal situation and the strains on the US deficit. President Biden used his FY 2025 budget to propose tax changes that would impact high-income individuals and corporations, including:

- Restoring the top tax bracket to 39.6% up from 37%. The individual tax cuts enacted in 2017 expire at the end of 2025 and at that time the highest tax bracket will revert to 39.6% unless Congress acts.

- Increasing the net investment income tax (NIIT) and the additional Medicare tax for those earning more than $400,000 a year from 3.8% to 5% and applying the NIIT to business owners’ profits received from pass-through businesses.

- Taxing long-term capital gains and qualified dividends at ordinary income rates for those earning more than $1 million in income and taxing unrealized capital gains at death for gains above a $5 million exemption ($10 million for joint filers), bringing the capital gains rate for these individuals to 44.6% if the highest tax rate reverts to 39.6% and the 5% NIIT tax goes into effect.

- Creating a 25% minimum tax on households worth more than $100 million, applied to earnings as well as capital gains.

- Requiring distributions of individual retirement account (IRA) contributions in excess of $10 million and prohibiting rollovers to Roth IRAs for individuals with $400,000 in income.

- Taxing carried interest as ordinary income for those earning more than $400,000.

- Repealing the tax deferral on gains from like-kind exchanges that are greater than $500,000 per taxpayer.

- Limiting the benefit of the generation-skipping transfer exemption to beneficiaries who are no younger than that of the transferor’s grandchild or who are members of a younger generation who were alive at the creation of the trust.

- Requiring the remainder interest in a Grantor Retained Annuity Trust to have a minimum gift tax value of the greater of 25% of the assets or $500,000, no decrease in the annuity during the GRAT term, and a minimum 10-year term and a maximum term of the life expectancy of the annuitant plus 10 years, in order to reduce the use of GRATs.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.