Preparing for A New Tax Landscape

You may be affected by a series of potential changes to our federal tax code set to occur in a couple of years. Baird’s Director of Advanced Planning Tim Steffen breaks down the background of these changes, what the changes may include, the potential implications, and how to prepare.

What is the Tax Cuts and Jobs Act (TCJA)?

In 2017, Congress passed a bill known as the Tax Cuts and Jobs Act, or TCJA, resulting in substantial changes to the federal tax code. While the bill increased the lifetime gift & estate tax exemption, creating a unique estate planning opportunity for certain taxpayers, it also included sweeping changes to how income and expenses are treated for tax purposes – changes that have a much broader impact. However, many of these provisions are scheduled to sunset at the end of 2025, meaning absent any new legislation, our current tax code will revert to rules that were in place nearly a decade earlier.

What do we mean by “sunsetting”?

Because of the sunset provision, large portions of the TCJA are scheduled to automatically expire after 2025. And while that’s how the law is written today, it’s unlikely that all of the provisions will expire and revert to old rules in 2026. Instead, it’s more likely that Congress will pass a new bill: extending some provisions, modifying others and letting a few expire.

As Congress works out the details, you should prepared for a lot of speculation, proposals and angst over how our income tax system will operate in 2026 and beyond. Scenario planning is even more important during this uncertainty, and your Baird Financial Advisor is ready to make sure you’re aware of future planning opportunities.

What are the expected changes to tax rates?

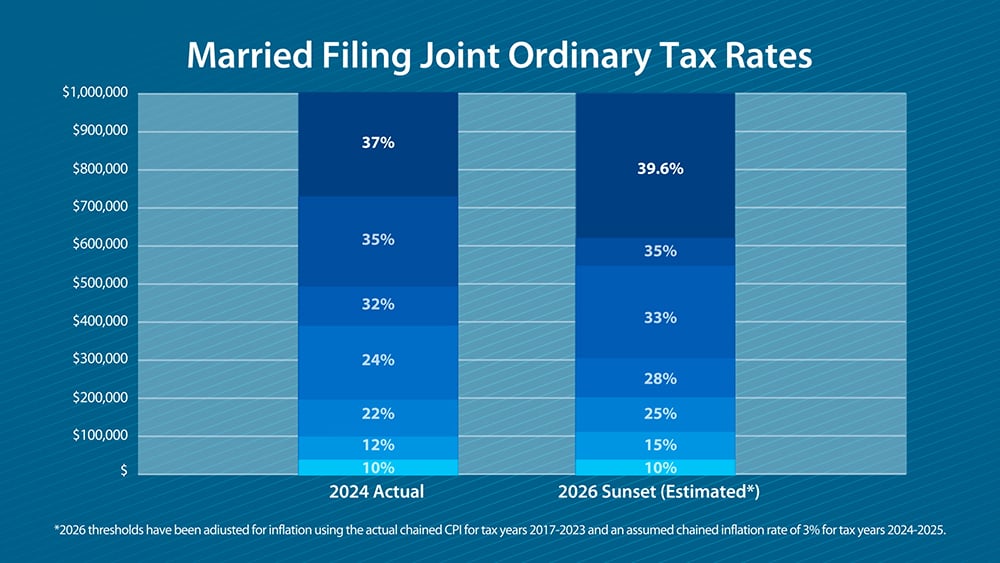

A sunsetting of the current rules would result in tax rates increasing by roughly 2 to 4 percentage points. In addition, the income ranges those rates apply to would be adjusted, meaning you would sometimes reach those higher tax rates at lower levels of income.

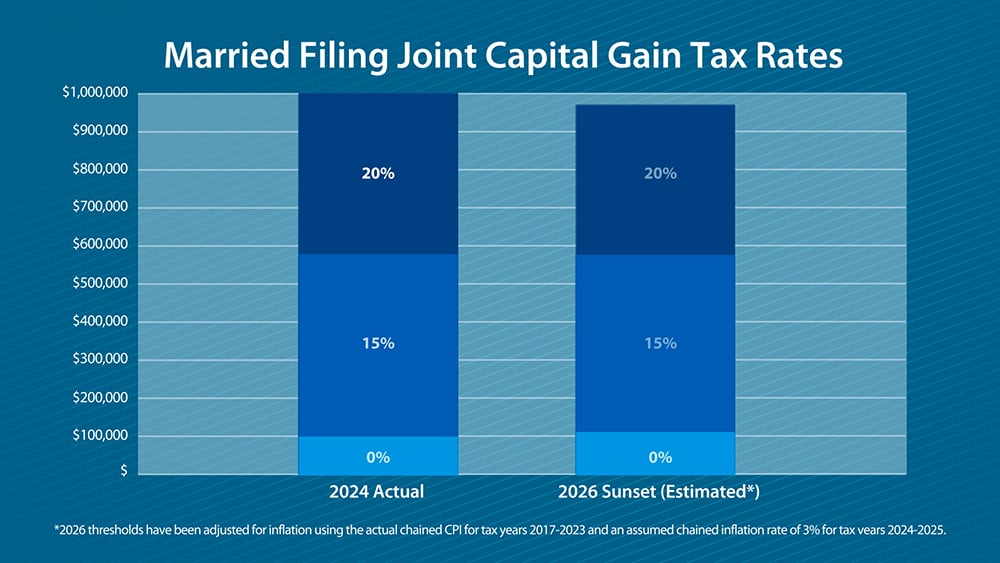

This chart shows the ordinary income rates and brackets for a married couple in 2025 compared to Baird’s estimate of what those brackets might look like in 2026. Exact income ranges for 2026 would depend on inflation adjustments, but this chart provides a reasonable estimate. While these ordinary income brackets would change significantly, the tax rates and brackets for capital gains and dividends would only be adjusted slightly.

Looking at these charts, it’s easy to conclude you will pay more tax in 2026 than you did in 2025. In many cases, that would be correct. As a result, strategies that help pull your income out of 2026 and into an earlier year can be attractive, such as:

- Exercising stock options

- Recognizing capital gains

- Doing a Roth conversion

However, tax rates are only part of the equation when it comes to your total tax cost. Another set of changes involving deductions and credits could help drive that tax cost back down, although not for everyone.

What are the expected changes to deductions and credits?

One of the biggest changes in the TCJA was the restriction it placed on itemized deductions. Itemized deductions are expenses you incur that can be used to reduce the amount of income subject to tax. The TCJA restricted or even eliminated many of these deductions. Under sunsetting, these changes would be reversed.

If the sunset occurs:

- The $10,000 limit on deduction for state and local taxes, commonly referred to as the SALT limit, will be removed, meaning you can once again deduct the full amount of those taxes.

- You’ll also be able to deduct a variety of miscellaneous expenses like investment and tax preparation fees, unreimbursed business expenses, and more.

- Interest paid on your mortgage or even on a home equity loan would become easier to deduct as well.

It’s not all good news, however. Sunsetting would also bring back the deduction phaseout rules, meaning those with income over a certain level would begin to lose their deductions.

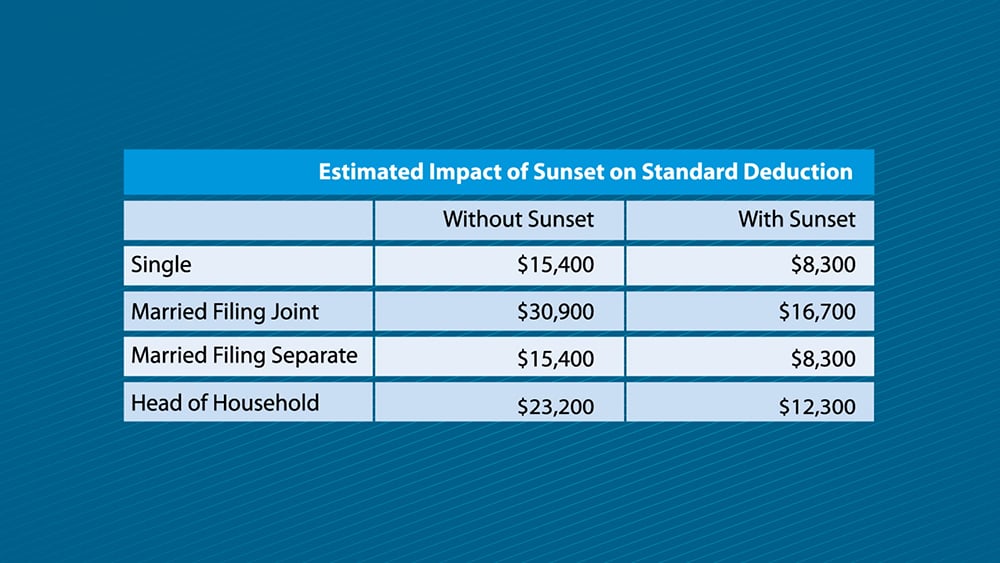

And while these changes to the deduction rules are important, they are expected to affect less than one-third of all taxpayers. That’s because most use something called the standard deduction. This is a flat amount available to all taxpayers, and is something used most often by younger individuals, retirees or those who don’t own a home. Under the TCJA sunset, this flat amount would fall back to almost half the level it’s at today. For a married couple that claims the standard deduction, that could mean as much as $13,000 in additional taxable income.

As a result of these changes, you should be careful about when you pay deductible expenses, in particular charitable contributions. With the standard deduction potentially falling in 2026, it will be easier to itemize deductions that year, meaning expenses like charitable contributions are more likely to provide a tax benefit in 2026. As a result, delaying 2025 gifts into 2026 could prove valuable. The same could be true of 2025 state income and property tax payments, although the benefit there could be harder to evaluate because of yet another change we could see in 2026: the return of the Alternative Minimum Tax.

For the last several years, the Alternative Minimum Tax, or AMT, has been almost forgotten about, with it only applying to those with unique tax situations. That wasn’t the case prior to the TCJA, and under sunsetting, we could very well return to the days where the AMT rules create an additional tax cost for many. This complicates planning around the other changes we’ve discussed, especially for those living in states with high state income tax rates.

The tax benefits available for members of your family would also change under sunsetting. In 2026, the child credit would fall in half to $1,000, and the $500 dependent credit would go away. On the flip side, we’d see the return of the personal exemption, a deduction you claim for each person in your household. However, both the credit and the personal exemption would be subject to a phase-out, eliminating those benefits for those at higher income levels.

How does the TCJA sunset impacts business owners?

Not all aspects of the TCJA are subject to the sunset provisions. In fact, most items affecting businesses were made permanent in the original bill. This includes the lower tax rate on C Corporations and the expanded Section 179 deduction, but also limitations on like kind exchanges, the deduction for interest expense and using prior year losses to offset current year income.

One business change that is scheduled to sunset, however, is the Qualified Business Income deduction, or QBI. This deduction allows owners of pass-through businesses such as sole proprietorships, partnerships and S Corporations to exclude up to 20% of their income from tax. This deduction was meant to level the playing field between these entities and C Corporations and their new, lower tax rate. If the QBI deduction does go away, business owners might have to consider whether converting their company to a C Corporation makes sense.

So now what?

As noted previously, the TCJA’s potential sunset won’t occur until after 2025, with its potential implications taking effect in 2026. However, your Baird Financial Advisor will continue to keep an eye on this situation and its implications for you. With the latest in planning tools, as well as a team of experienced tax and planning professionals, Baird will work together with you to best manage your total tax cost over the next few years.

In the meantime, you should expect to hear any number of proposals coming out of Washington to address these changes. When you hear these proposals, though, be careful not to over-react. Proposals tend to be light on details, and actual bills can change up until the day they’re passed. It’s best to wait and see what happens, and then be prepared to respond.

Your Baird Financial Advisor is prepared to help you sift through the noise and discuss the best planning strategies given your unique situation. We look forward to partnering with you as these changes begin to take effect.

This article was originally published in September 2024 and was updated with more current information in June 2025.

This information has been developed by a member of Baird Wealth Solutions Group, a team of wealth management specialists who provide support to Baird Financial Advisor teams. The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.