2025 Market, Policy and Planning Outlook

Every year comes with opportunities to make the most of your wealth plan, and 2025 is no exception. Our macroeconomic and wealth planning experts outline the key planning moves to consider for the year to come.

Market and Policy Outlook

Nicholas Bohnsack

Nicholas Bohnsack

President and COO of Strategas, a Baird company

What is your outlook for the U.S. stock market and economy in 2025?

We have a positive outlook for equities in general (and the U.S. in particular) as we move into 2025. The economy seemed to end 2024 on firm footing and that looks set to continue—we take note of the strength in corporate profits estimates through the middle of the year. The market seems to have taken the new administration’s pro-growth policy initiatives positively, and extraordinary liquidity measures could be a shot in the arm as the U.S. government reaches the debt ceiling. As always, we'll be on the lookout for things that could make us wrong, and we do take note that while the U.S. economy grew at a healthy 3% rate for the last three quarters of 2024, that’s a tough pace to maintain. So, we think the U.S. economy will continue to expand but at a slightly softer growth rate in 2025. And lastly, we see expectations for Fed rate cuts as a positive for the stock market. There was a point last fall when investors anticipated as many as 10 cuts and that’s dwindled to just three more from here. We expect two cuts in 2025, and not before June. So, on balance, we have a healthy outlook for the economy that’s predicated on fundamental and economic growth, but we’re on the lookout for a softening slope of economic growth and a further reduction of Fed rate cuts.

What do you see as the biggest or most under-discussed risk to your 2025 outlook?

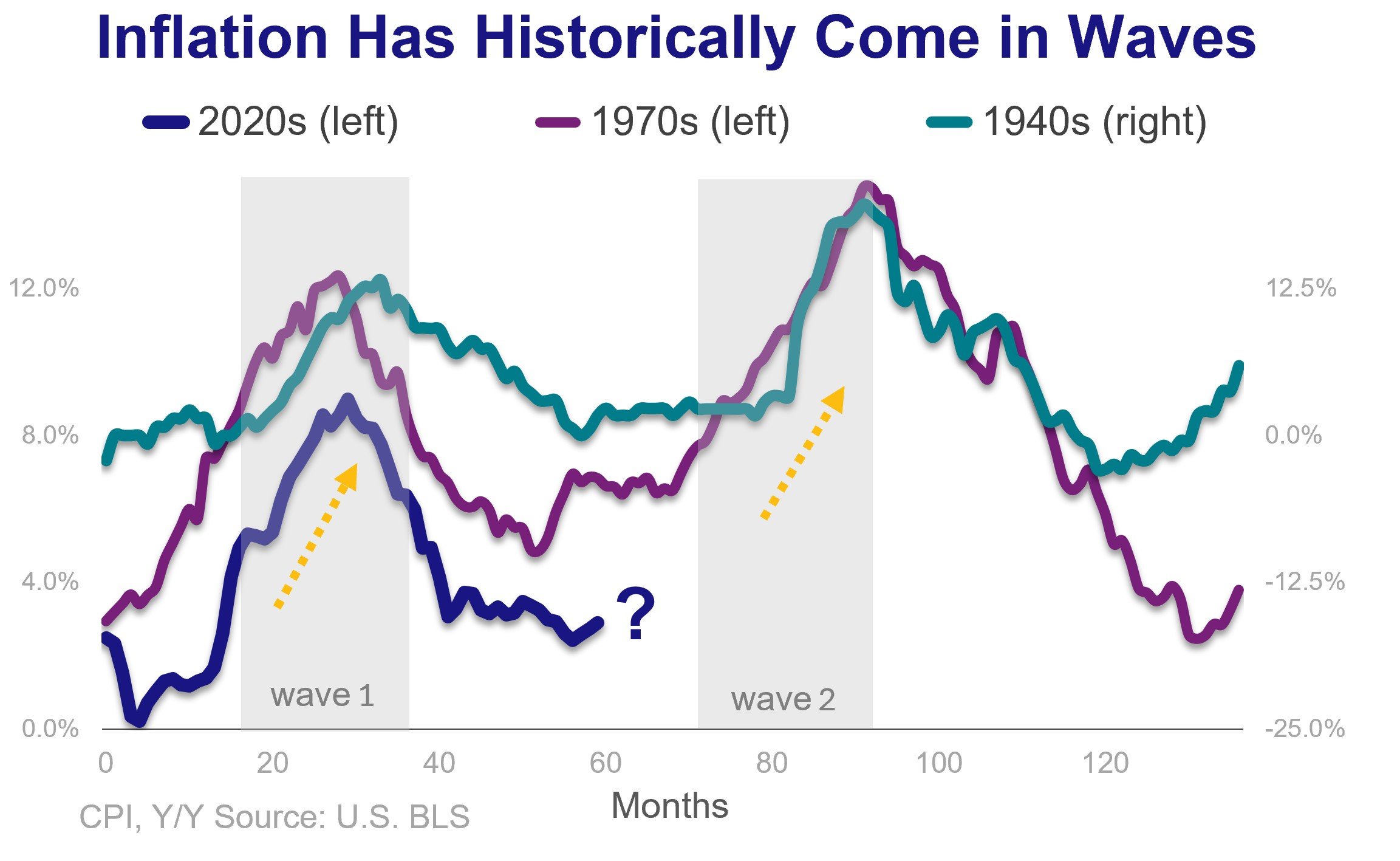

The first risk we’d highlight is inflation. If history is a guide, developed economies generally see inflation play out in two waves. So, while inflation has come back down to the 3% level (from as high as 9% in 2022), it’s unclear whether we've fully taken our medicine to suppress inflation in perpetuity. We’ll be on the lookout for signs of reacceleration toward the end of 2025 and into 2026 that could put rate hikes back on the table. That’s not our base case, but we want to be mindful of it. The second risk is corporate, and profit margins by extension. Consensus forecasts are for double-digit earnings growth in 2025 and we're just below that at a relatively healthy 8.5%-9.0%. However, if a slowing economy leads to slower sales, that will make it harder for firms to deliver on profit margin expectations—and could be taken as a negative sign by the market.

How might proposed immigration and tariff policies impact inflation and interest rates?

While much attention has been paid to the Trump administration's trade and tariff policies, we remain generally skeptical of their desire to increase tariffs through a universal trade measure, and would rather focus on 1) China, in slightly more retaliatory terms; and 2) tariffs as a negotiating tactic with other U.S. trade partners. We’ve seen that, on balance, tariffs raised and left in place for long periods of time can put upward pressure on the general price level. That said, we would be more concerned about the administration's proposals on immigration. Deporting large shares of the labor force, particularly those at the lower end of the income spectrum, could put upward pressure on prices and deporting this group rapidly could be slightly destabilizing to the economy. So, we'd be on the lookout for follow-through on the administration's proposals from the campaign. On balance, as noted earlier, upward pressure on inflation would call the Fed back into the game and we could see incremental Fed rate raises priced into the market toward the end of this year and into 2026. We’ll be watching that closely.

Planning Outlook

Heather Osborn, CFP®, AAMS®, CExP™, CWA®, CLU®

Director of Wealth Planning

Tim Steffen, CPA-PFS, CFP®, CPWA®

Director of Advanced Planning

Three Key Developments for 2025

While we know that tax policy will be a hot button issue this year, it’s worth first reflecting on the new things that have already taken effect for 2025:

- Super Catch-Up Contributions: While catch-up contributions have long been available to workers age 50 or older, there is a new opportunity for workers between age 60 to 63 to contribute an additional $3,750 to their employer-sponsored retirement plans, providing a nice boost to your savings.

- New Inherited IRA Rules: The IRS finalized their rules on inherited retirement accounts, which will be fully enforced for the first time in 2025. As a result, most beneficiaries who inherited a retirement account in 2020 or later will have to take a minimum distribution from the account this year, as well as plan to empty the account within 10 years of the owner’s death. There are a lot of exceptions and nuances to these rules, so if you’re a beneficiary of an inherited IRA, it’s best to connect with your Baird Financial Advisor to understand how these rules will impact you.

- Social Security Fairness Act: At the end of 2024, Congress enacted a bill that eliminated two provisions of the Social Security system – the Government Pension Offset and Windfall Elimination Provision – that led to reduced benefits for some workers. The Social Security Administration has yet to announce how these rules will be implemented, but ultimately this will mean larger benefits for many retirees and their families this year. As more details emerge, Baird will be sure to provide you with any important updates.

Notable Tax Adjustments for 2025

While inflation has slowed a bit, it’s still had a meaningful impact on our tax system, with shifts to the income and capital gain tax brackets, the standard deduction, contribution limits, qualified charitable distributions, and gifting limits.

|

|

2025 | 2024 |

| Standard Deduction | $30,000 (MFJ), $15,000 (S) | $29,200 (MFJ), $14,600 (S) |

| Additional Deduction (Age 65+) | $1,600/each (MFJ), $2,000 (S) | $1,550/each (MFJ), $1,950 (S) |

| 401(k) / 403(b) Contribution | $23,500 | $23,000 |

| SEP IRA Contribution | $70,000 | $69,000 |

| Traditional/Roth IRA Contribution | $7,000 | $7,000 |

| Qualified Charitable Distribution | $108,000 | $105,000 |

| Annual Gift Exclusion | $19,000 | $18,000 |

| Lifetime Gift & Estate Exclusion | $13.99 million | $13.62 million |

Sunsetting of the Tax Cuts and Jobs Act

Tax policy is expected to take center stage in Washington this year. When Congress passed the Tax Cuts and Jobs Act in 2017, it included sunset provisions for will have implications for income tax and legacy and estate planning. Given that proposed bills can be changed until the day they are passed, it's important to not front-run any changes. Once there is resolution, Baird’s tax and policy experts will provide plenty of analysis and explanation to help inform any strategies. It’s also worth noting that any changes are unlikely to take effect this year, hopefully leaving plenty of time for you and your Baird advisor to plan out just how to respond to whatever is coming in 2026.

Control What You Can Control

Instead of getting caught up in what changes may be coming from Washington, it’s worth focusing on the things within your influence:

- Revisit your emergency fund

- Explore liquidity options

- Review your insurance coverage

- Review your estate plan and powers of attorney

Once you’ve addressed the immediate risks in your life, it’s worth looking at your longer-term planning:

- Are you maximizing your retirement savings?

- Are you setting aside funds for loved ones’ education?

- How are you best managing your tax exposure with any investment or planning decisions?

Tax season is often a time for people to see the real implications of the financial decisions they made over the past year. Your Baird Financial Advisor has access to the latest tools and industry experts who can assist with proactive planning to ensure you’re not missing out on any opportunities this year, or caught off guard by any tax surprises in the year to come.

As we look forward to 2025 and all that it may bring, remember not to lose sight of what’s important, and to not get distracted by what’s unimportant. Whether it’s rumors out of Washington, chatter on social media or volatility in the markets, remember to base your actions and decisions on facts and not emotions. And don’t forget that your Baird Financial Advisor team, backed by Wealth Planning experts, is here to help you plan for the best possible financial future for you and your family.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.