In the Market Now: AI and Investment Risks

We believe in the old saying: a picture is worth a thousand words. Here, we aim to recap recent market action and provide some perspective to investors.

On Being Invested for Unexpected Booms

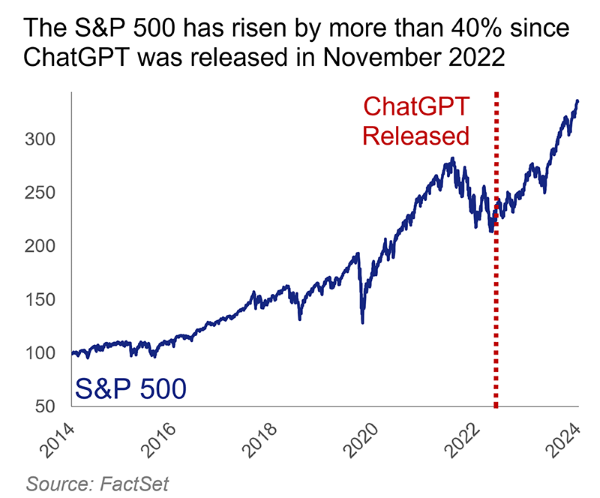

On November 29, 2022, the S&P 500 was down nearly 20%, interest rates and inflation were spiking, and recession predictions were as abundant as they’d been in decades. Money was fleeing stocks, investor sentiment was dour, and consumer sentiment was even worse. It was a difficult moment in time for America. But then, overnight, the course of history shifted. On November 30, 2022, a little known company named OpenAI released a chatbot called ChatGPT and lit the fuse of the artificial intelligence (A.I.) explosion that we’re in the early stages of. Since then, the S&P 500 is up over 40% and the Nasdaq is up nearly 75%.

Long-term investing works because capitalism incentivizes innovation via competition for profits. The stock market has gone up over time because so, too, have the earnings of its underlying firms. While there will be winners and losers in each business cycle, the overall market will almost surely benefit from higher corporate profits and a growing U.S. economy over time. Now, whether A.I. can fulfill all of the lofty expectations being laid at its feet is a fair question – valuations are certainly rich – but there is increasingly little doubt that it will have a big impact on how we live and do business. The market’s recent gains reflect this expectation, and those still invested at the depths of the ’22 bear market have reaped the reward.

We often return to the idea that the biggest risks are the ones we don’t see coming – 9/11, Covid-19, etc.; that any highly discussed and well-understood risks are already being priced in, rendering the probability of catching markets truly off guard somewhat lowered. But anything genuinely unexpected will always have an outsized impact. And while we typically discuss this idea in terms of downside risk (as our human proclivity towards a negativity bias almost guarantees), it applies to upside “risk,” as well. In October 2022, no one was talking about an A.I. boom that might drive a massive capital investment cycle and worker productivity boom. But then, quickly, they were – and markets reacted in kind.

For most long-term investors, the biggest risk is actually not a market downturn anyway – those have been common throughout history and will continue to be as long as humans are behind the wheel. Rather, the biggest risk is being out of the market during a significant up-move. Compounding market gains over long periods of time is near-reliant on being invested during high performance periods, and missing even a handful of the best days – much less the best months or years – is crippling to long-term wealth creation.

Past that, the psychological hurdle of putting money to work after missing a major rally is enormous. Across March and April 2020, roughly $1.3 trillion flowed into money market funds (cash) seeking refuge during the uncertainty of the pandemic. Not unreasonable by any means, but the cost of that certainty turned out to be huge: since the end of April 2020, the S&P 500 has doubled. And perhaps more importantly, the market never again came close to those March 2020 lows. Any chance to put cash back into stocks would have come at a much higher price level, and if I were a betting man, I’d wager that a majority of that Covid-era cash is still on the sidelines, having missed one of the great four year market runs in the last century.

Stocks will always be volatile, but through a longer-term lens it is clear that the risk of being out of the market during some-thing like the A.I. boom is far greater than that of being in the market during a selloff. We can debate the ultimate impact that artificial intelligence will have over time, but like countless other productivity-enhancing technologies before it, A.I. surely represents yet another rung on the long ladder of human innovation and growth. And as with those prior “rungs,” profits will accrue to the stockowners who were along for the ride. We will want to be invested for whatever comes next, as well.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Any market and economic statistics not otherwise cited come from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2024 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.