Key Policy Themes for 2024

Strategas Washington Policy Research

This year looks to be the largest global election year in history, and the US election is expected to have a global impact.

With so many elections happening across the world in 2024, this year is likely to be the largest election year in world history (defined by the number of people who will vote in 2024). Our research calculates that roughly 70% of the world’s stock market capitalization will be voting for a head of government in 2024. At the same time, the US election results are likely to have a global impact all on their own, with big implications for specific countries given the wide differences among candidates on foreign policy, tariffs, and economic regulation. Given the large divergence on trade policy in particular, we expect non-US markets highly levered to US trade policy to correlate with the odds of potential US election winners.

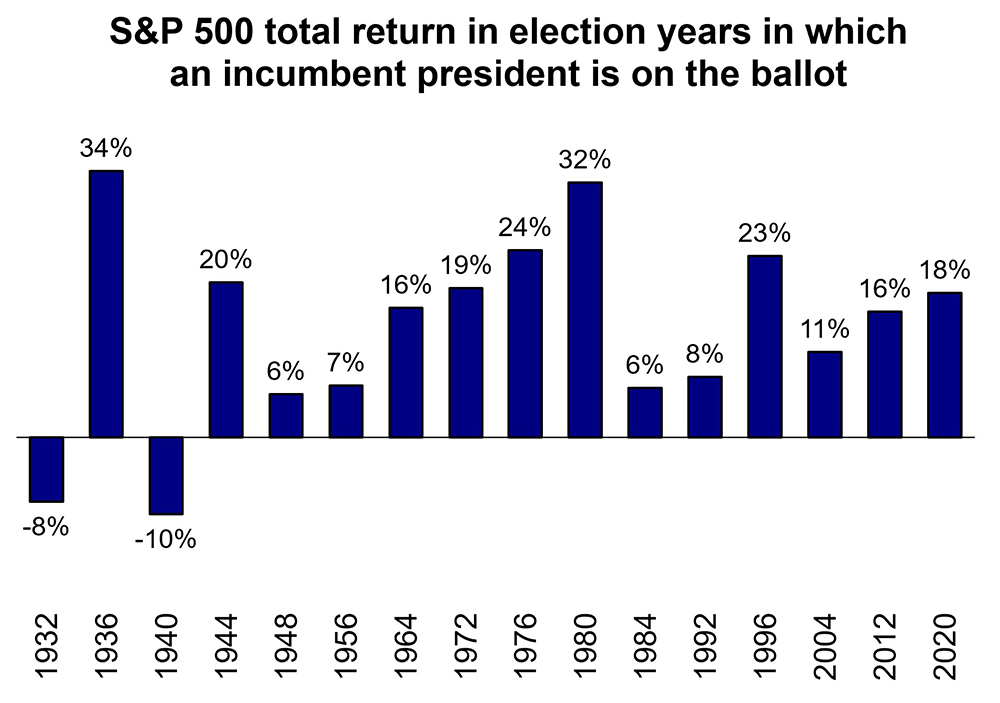

The S&P 500 has increased in 13 consecutive presidential re-election years. Despite the noise of elections, stocks have done well in presidential election years – and, more specifically, in years in which an incumbent president ran for re-election. In fact, the S&P 500 has not declined in a presidential re- election year since 1940. We believe this happens because presidents use the tools available to them to boost the economy ahead of their re-elections. Even in recession years, these actions mitigated the severity of the downturn. We expect these tools to be used in 2024, as well – things like additional infrastructure spending, cutting student loan payments, boosting US oil production, and financing the deficit on the short end of the Treasury curve. In addition, Congress is likely to consider tax measures this year and the Federal Reserve is likely to cut interest rates.

The S&P 500 has increased in 13 consecutive presidential re-election years. Despite the noise of elections, stocks have done well in presidential election years – and, more specifically, in years in which an incumbent president ran for re-election. In fact, the S&P 500 has not declined in a presidential re- election year since 1940. We believe this happens because presidents use the tools available to them to boost the economy ahead of their re-elections. Even in recession years, these actions mitigated the severity of the downturn. We expect these tools to be used in 2024, as well – things like additional infrastructure spending, cutting student loan payments, boosting US oil production, and financing the deficit on the short end of the Treasury curve. In addition, Congress is likely to consider tax measures this year and the Federal Reserve is likely to cut interest rates.

Stimulus moves from consumer aid toward investment programs. The considerable consumer aid enacted during the Covid-19 pandemic is ending, removing support for the US consumer heading into an election period. Most notably, spending on food stamps (SNAP) is rolling off at a rapid pace as the program is normalized back to its pre-pandemic form. Medicaid spending is also rolling off, student loan payments have resumed, and tax refunds are coming down. However, as spending on these programs continues to wind down, new investment spending is coming online to build up US infrastructure. This includes funding for the already enacted bipartisan infrastructure law, the Inflation Reduction Act (renewable energy tax credits), and the CHIPS & Science Act (semiconductor manufacturing). These legislative measures passed in 2021 and 2022, but the money does not really start to flow until this year given the long lag times for funding to get out the door. We expect approximately $80 billion in these funds to be spent in 2024.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This report does not provide recipients with information or advice that is sufficient to base an investment decision on. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Fixed income yield and equity multiples do not correlate and while they can be used as a general comparison, the investments carry material differences in how they are structured and how they are valued. Both carry unique risks that the other may not.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Strategas Asset Management, LLC and Strategas Securities, LLC are affiliated with and wholly owned by Robert W. Baird & Co. Incorporated, a broker-dealer and FINRA member firm, although the firms conduct separate and distinct businesses.

Copyright 2024 Robert W. Baird & Co. Incorporated.

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.